Advertisement|Remove ads.

Patient Death In Rocket Pharma Trial Triggers Downgrades, But Retail Traders Bet Big On Strong Recovery

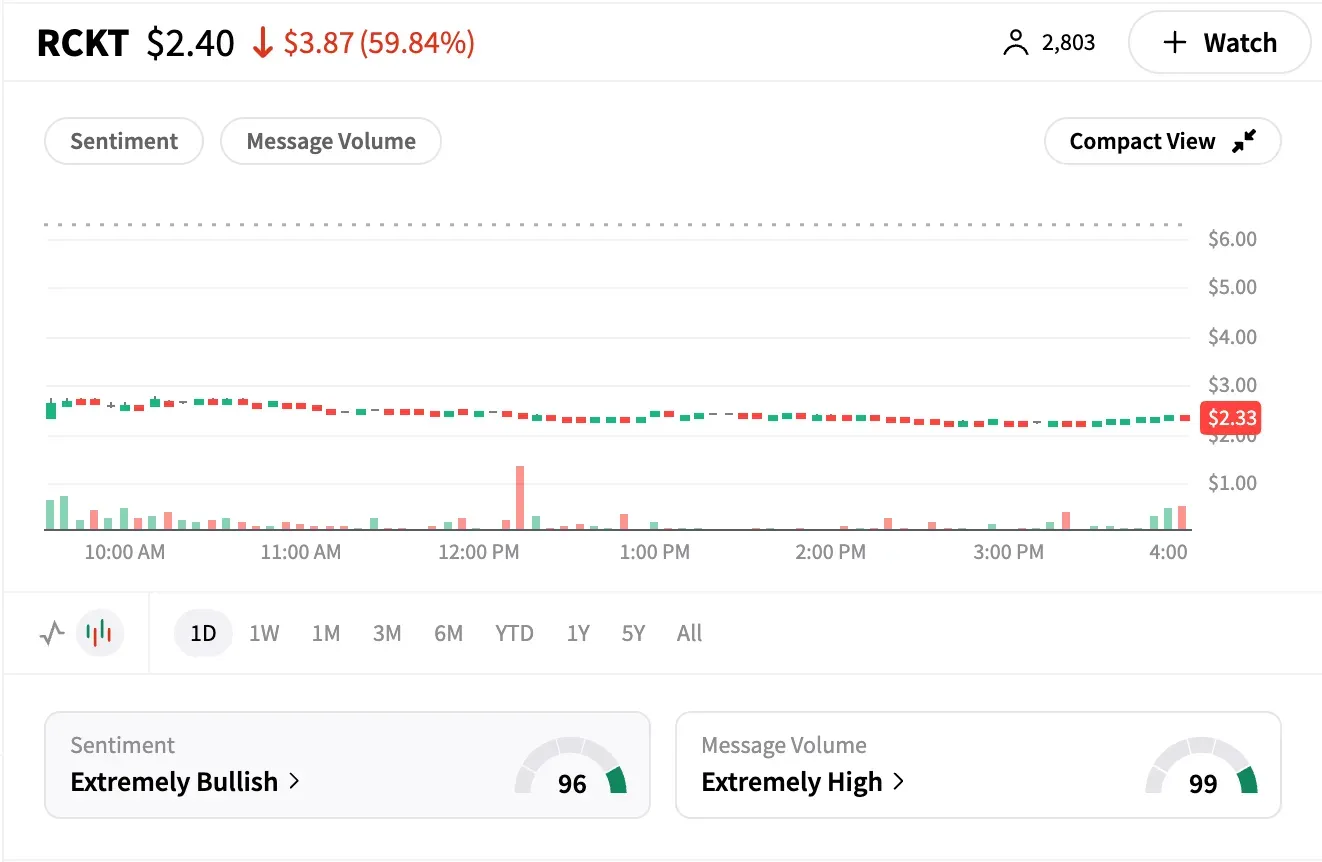

Rocket Pharmaceuticals (RCKT) plunged nearly 63% on Tuesday, hitting an all-time low after the U.S. FDA placed a clinical hold on its gene therapy trial, RP-A501, for Danon disease following the death of a patient.

The selloff marked the company's worst session on record.

Despite the steep decline, retail investor sentiment remained notably bullish. Message volume on Stocktwits spiked to ‘extremely high’ levels, and the ticker added 20% more watchers over the past 24 hours — the highest among healthcare stocks on Tuesday.

Wall Street Turns Cautious

According to The Fly, the incident prompted a wave of downgrades from major analysts:

- Morgan Stanley cut RCKT to 'Equal Weight' from 'Overweight' and slashed its price target from $42 to $7, which still implies more than 200% upside from current levels.

- Leerink lowered its rating to 'Market Perform' from 'Outperform' with a new target of $8. The firm cited three overhangs: safety concerns, shaken investor confidence, and financial pressure.

- TD Cowen downgraded the stock to 'Hold' from 'Buy,' citing unresolved safety risks related to thrombotic microangiopathies that preceded the addition of the C3 inhibitor.

- Needham also moved to 'Hold' from 'Buy' and withdrew its $42 target, calling RP-A501 the company's "main value driver" but now fraught with uncertainty.

Retail Shrugs Off Worries

Despite the institutional pullback, retail traders doubled down. Stocktwits sentiment turned 'extremely bullish,' with many users arguing that Rocket's broader pipeline remains compelling.

One optimist expects the stock to be "back over $4.50 (maybe $5) within 3 months."

"For one moment, ignore the CV gene therapy, which is the cause of today's drop, and just look at the rest of the pipeline here. Particularly late-stage hematology," posted another, citing the firm's leadership, including CCO & CMO Sarbani Chaudhuri, formerly with Johnson & Johnson.

RCKT shares gained about 3% in after-hours trading following the plunge in the regular session.

The episode echoes a March setback for Sarepta Therapeutics (SRPT), when a patient receiving its approved Duchenne muscular dystrophy therapy died from liver failure.

As Barron's noted, such high-profile incidents have made gene therapy stocks increasingly unpalatable for many investors, despite the field's early promise.

Rocket Pharma shares are now down over 80% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_kalshi_logo_jpg_d4ea268948.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1249125319_jpg_31d1207b8e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tilray_Brands_jpg_add037e8e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)