Advertisement|Remove ads.

Red Cat Stock In Spotlight After Massive Revenue Growth Outlook

- The full-year 2025 revenue is projected to reach between $38.0 million and $41.0 million, reflecting a 153% year-on-year jump.

- Company cited strong demand from defense and government customers.

- Following the update Red Cat stock traded over 2% higher on Tuesday morning.

Red Cat Holdings, Inc. (RCAT) stock drew investors’ attention on Tuesday after the company announced its revenue outlook for the fourth quarter (Q4) and full year of 2025.

The company makes high-tech drones and robotic systems for defense and security, for use on land, in the air, and at sea.

Explosive Growth Projection

Red Cat expects Q4 revenue to fall between $24.0 million and $26.5 million, marking a staggering 1,842% year-on-year increase. The full-year 2025 revenue is projected to reach between $38.0 million and $41.0 million, reflecting a 153% jump from the $15.6 million recorded in 2024.

This compares to the analysts’ consensus estimate of $21 million and $35 million respectively, according to Koyfin data.

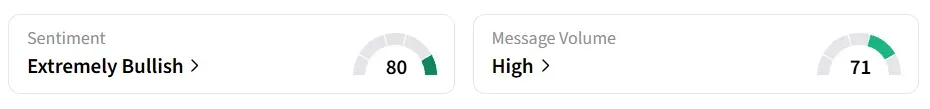

Red Cat stock traded over 2% higher on Tuesday, after the morning bell. On Stocktwits, retail sentiment around stock remained in ‘extremely bullish’ territory amid ‘high’ message volume levels.

“This outperformance was driven by robust demand from defense and government customers, expanding program wins, and our ability to rapidly scale production to meet mission-critical requirements.”

-Jeff Thompson, CEO, Red Cat

Government Contracts

Last year, Red Cat secured a small-scale initial production deal for its surveillance drones as the U.S. Army increased drone operations, after the Trump administration eased several rules on unmanned aircraft.

In September, the company revealed that the Black Widow System, made by its subsidiary Teal Drones, received approval and was officially listed in the NATO Support and Procurement Agency (NSPA) catalogue.

The Black Widow has a flexible design that allows it to quickly adjust to different mission needs, including short-range reconnaissance with optional AI software features.

RCAT stock has gained over 30% in the last 12 months.

Also See: FBIO Stock Surges 12% Pre-Market After It Wins FDA Approval For Rare Pediatric Menkes Disease

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es8_jpg_6097d170b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_76024286_jpg_1a0537b0fc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_a4b797d3d6.webp)