Advertisement|Remove ads.

Regeneron Stock Down 30% Over Past 6 Months: Leerink Sees Buying Opportunity, Retail's On The Same Page

Shares of Regeneron Pharmaceuticals have plunged more than 30% over the past six months, but one Wall Street analyst believes the sell-off has created an attractive buying opportunity.

While fourth-quarter sales of Eylea — Regeneron's blockbuster eye disease treatment — missed analyst expectations, the company still posted a revenue beat and announced a $3 billion share buyback program.

According to a CNBC report, Leerink Partners analyst David Risinger upgraded the stock to 'Outperform' on Wednesday and raised his price target to $834 from $762. This implies about 15% upside from current levels.

Risinger sees 2025 as a challenging year due to Eylea headwinds but expects growth to accelerate in 2026, driven by strong eczema treatment sales from the company’s Dupixent drug.

"Our thesis is that REGN’s financial growth will accelerate in 2026, its pipeline will advance, and the P/E [price to earnings] multiple will expand," Risinger wrote, adding that the company's “an extraordinary history and culture of innovation” remains undervalued.

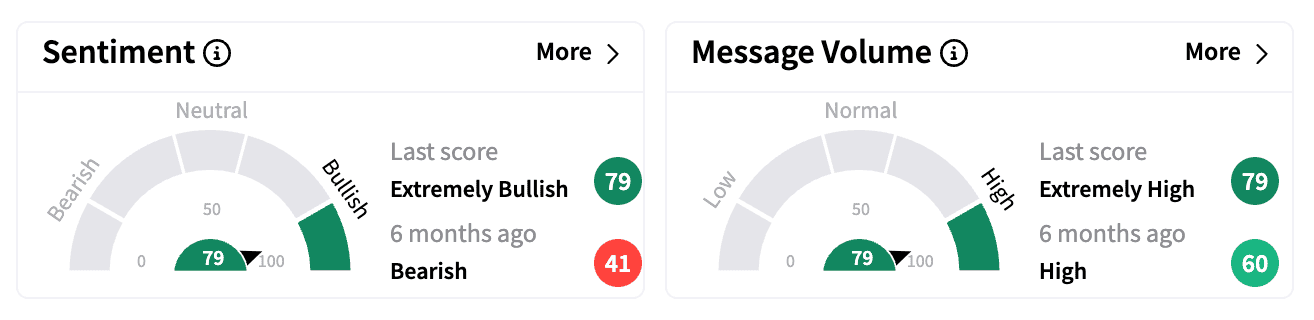

Retail investors appear to share that optimism. On Thursday, sentiment for Regeneron on Stocktwits flipped to 'extremely bullish,' a sharp contrast from the 'bearish' reading six months ago.

Message volume on the platform about the stock has jumped by more than 170% over the last three months.

Adding to the positive momentum, Regeneron announced a clinical supply agreement with Immuneering on Thursday for its anti-PD-1 therapy, Libtayo.

The deal supports a Phase 2a clinical trial evaluating Immuneering's lead drug, IMM-1-104, in combination with Libtayo for RAS-mutant non-small cell lung cancer (NSCLC).

Regeneron's stock took a significant hit in September after a court ruling raised the possibility of Amgen launching a biosimilar competitor to Eylea earlier than expected.

A federal judge in West Virginia denied Regeneron's request for an injunction against Amgen's Pavblu, creating uncertainty around Eylea's U.S. market exclusivity.

At the time, Leerink's Risinger had downgraded the stock, warning that Amgen's early entry could disrupt Regeneron's ability to settle with biosimilar challengers.

Regeneron shares trade nearly 30% below Wall Street's consensus price target of $939.37, according to Koyfin data.

While the stock is up just 0.4% year-to-date, retail investors clearly see a rebound on the horizon.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)