Advertisement|Remove ads.

Reliance ‘A Diversified Play’ Ahead Of Jio, Retail IPOs: SEBI Analyst Sees Bullish Breakout Above ₹1,525

Reliance Industries' (RIL) shares have been in a consolidation mode, rising over 13% in the last six months. However, brokerages have been increasingly optimistic on Mukesh Ambani led telecom to retail conglomerate.

Citi shared a bullish outlook on Reliance, citing regulatory clarity from SEBI’s new listing norms. These revised rules are expected to facilitate the anticipated IPO of Jio Platforms in the first half of 2026. Reports also suggest that Reliance Retail is gearing up for an ambitious IPO in 2027, targeting a nearly $200 billion valuation.

SEBI-registered analyst Finkhoz RoboAdvisory called Reliance one of the most diversified plays in India, adding that the upcoming Jio and Retail IPOs will be major triggers for long-term investors. And in a booster shot, the recent GST rate rationalization across sectors, but more importantly autos and FMCG are likely to aid Reliance Retail’s consumer segment.

They also noted that the stock was showing a high-low formation on the weekly chart, which is an early sign of trend reversal.

RIL: Technical Outlook

Reliance is currently trading around ₹1,405, sitting right above the crucial ₹1,373 support zone, which also aligned with its 200-day Exponential Moving Average (EMA). Finkhoz highlighted that the stock was struggling near the ₹1,400–₹1,450 supply zone, which has acted as both support and resistance in the past. Buyers have been active in the 50-day EMA zone of ₹1,358

Its Relative Strength Index (RSI) stood at 52, indicating a neutral zone and moderate volumes show no signs of heavy accumulation yet, they added.

If Reliance stock sustains above ₹1,400, the next resistance lies around ₹1,500–₹1,525, with immediate support at ₹1,350.

Charts Show Bullish Signal

Reliance has defended its 200-day EMA multiple times, which is a strong sign of institutional buying. Finkhoz said that a breakout above ₹1,525 with strong volumes could trigger a fresh rally towards ₹1,600 and higher.

Finkhoz concluded that for Reliance, sustaining above ₹1,400 is key.

What Is The Retail Mood?

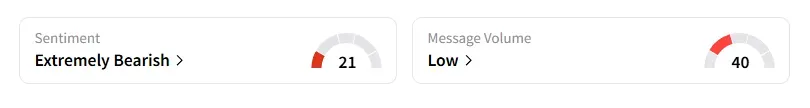

Data on Stocktwits shows that retail sentiment has turned ‘extremely bearish’ a day ago. It was ‘bearish’ a week ago.

RIL shares have risen 15% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)