Advertisement|Remove ads.

Restaurant Brands Seizes Full Control Of Burger King China In $158M Deal: Retail Stays Bullish

Shares of Restaurant Brands International Inc. (QSR) were in the spotlight on Tuesday after the company said its subsidiary bought a 100% stake in Burger King China for about $158 million in an all-cash transaction.

RBI acquired the stake from TFI Asia Holdings BV and Pangaea Two Acquisition Holdings XXIII Ltd, according to a statement.

With the deal, RBI plans to engage advisors to assist the company in identifying a new local partner to inject primary capital into the business and become the controlling shareholder.

RBI’s long-term strategy has been to partner with “experienced local operators” while maintaining a primarily franchised business, the company said in a statement.

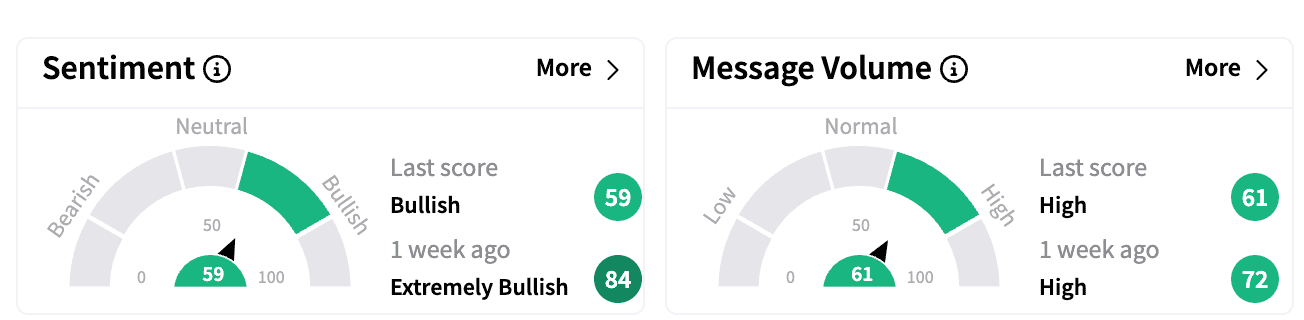

Sentiment on Stocktwits turned ‘bullish’ from ‘extremely bullish’ a week ago. Message volumes remained in the ‘high’ zone.

Under TFI’s watch Burger King has grown from about 60 restaurants in 2012 to 1,500, with plans to continue its expansion into Turkey, according to the statement.

According to Reuters, the company has been refining its China strategy for Burger King as it grapples with weakening demand in its second-largest market, amid pressured consumer spending and intense competition.

Restaurant Brands has nearly $45 billion in annual system-wide sales and over 32,000 restaurants in more than 120 countries and territories. Its brands include Tim Hortons, Burger King, Popeyes, and Firehouse Subs.

Restaurant Brands stock is down more than 1% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)