Advertisement|Remove ads.

Disney’s Magic Is Fading For Retail Traders — Now, Goldman Warns Of Q2 Footfall Dip At US Theme Parks

Retail trader buzz surrounding The Walt Disney Co (DIS) stream on Stocktwits has tapered off, highlighting waning interest in the stock. This could not have come at a worse time for the “Magic Kingdom.”

With a week to go for Disney’s second-quarter results, an analyst warned of a fall in its domestic theme park attendance.

By late Thursday, Disney’s 30-day change in retail message volume on Stocktwits plunged by 60%. Activity levels haven’t picked up much since the past month, with message volume still down 42% over the past week and 13% lower over the preceding 24 hours.

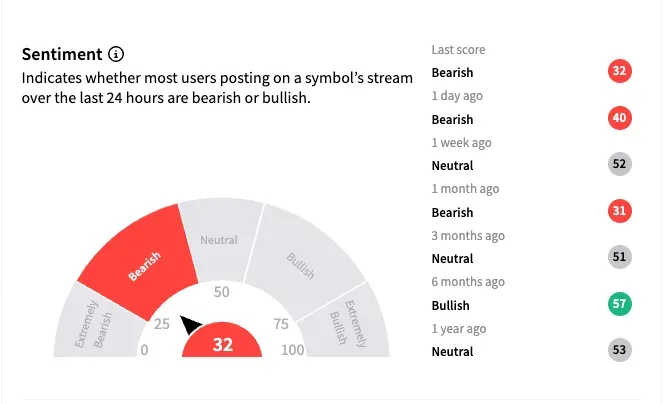

Retail sentiment toward Disney stock was ‘bearish’ (32/100) by late Thursday, with the bearishness worsening from a week ago.

In a note released late Thursday, Goldman Sachs analysts warned that Disney’s domestic attendance could have declined 1% year over year (YoY) in the second quarter of the fiscal year 2025, The Fly reported.

The research firm based the deduction on the 7% drop in Orlando airport arrivals in March. However, the decline may have to do with the Easter shift to April, potentially pushing travel plans to the month from March.

In the March quarter, the Experiences business, including contributions from domestic and overseas theme parks, resorts, and cruises, fetched $9.42 billion in revenue, roughly 38% of the total.

That unit accounted for a bigger 62% of the segment operating income, although domestic parks’ contribution fell 5% due to hurricane impact and cruise pre-opening expenses.

The company expects $40 million in cruise pre-opening expenses in the second quarter.

Overall, Disney is expected to report second-quarter earnings per share (EPS) of $1.22 and revenue of $23.12 billion, according to the Finchat-compiled consensus. This would mark flat EPS and 4.73% revenue growth.

Disney stock ended Thursday’s session down 0.15% at $90.81, although it is down 18.5% year-to-date.

The Koyfin-compiled consensus price target for Disney stock is $121.93, implying a potential 34% upside from current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)