Advertisement|Remove ads.

Where Will Nio Stock Close This Month? Most Retail Traders Bet On A Rebound To 4-Month Highs

EV maker Nio, Inc.'s U.S.-listed shares gained more than 8% last week, as investors expect strong financial results when the company reports fourth-quarter earnings this Friday.

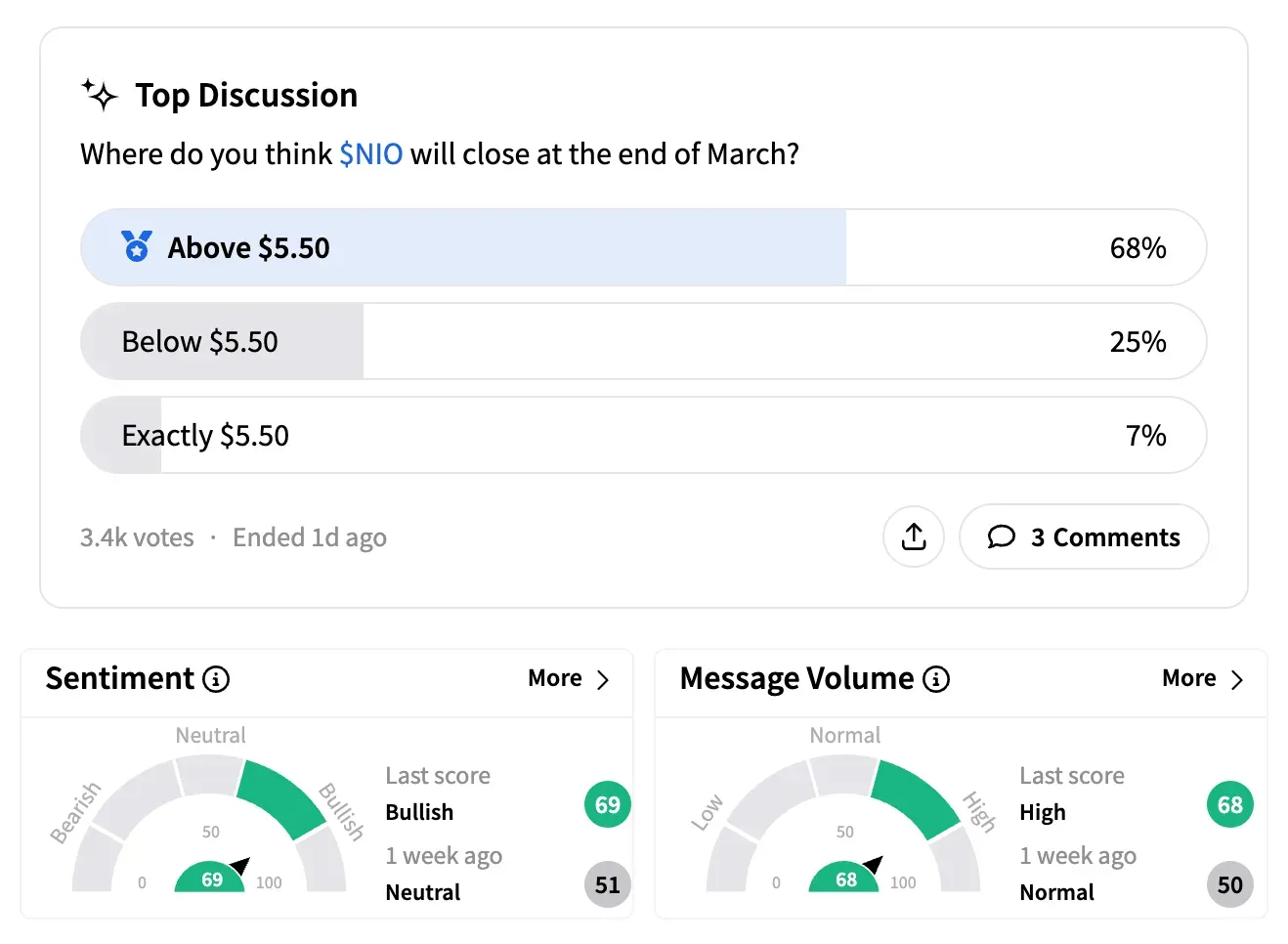

On Stocktwits, sentiment flipped from 'neutral' to 'bullish' over the past five trading days as retail traders pinned hopes on recent delivery numbers and expectations of more support from the Chinese government.

In February, Nio's deliveries rose more than 62% year-over-year to 13,192 vehicles, with the NIO brand accounting for 9,143 and ONVO for 4,049 vehicles. While that was better than rival Li Auto's nearly 30% jump, it fell short of Xpeng's 570% surge.

According to media reports, the China Passenger Car Association expects auto sales to stay strong in March, driven by post-Lunar New Year model launches and local government incentives.

A recent Stocktwits poll shows strong retail trader confidence in Nio surpassing its October highs. Of more than 3,400 respondents, 68% expect the stock to finish March above $5.50, 25% predict it will stay below, and 7% see it closing exactly at that level.

The stock has struggled to break past that resistance, mostly trading between $4 and $5.30 this year.

One user shared a technical chart, noting Nio's weekly setup suggests a "big move" could be on the horizon later this year. The user added that as "this wedge continues to tighten, any decent-sized bounce could finally lead to a break of this four-year downtrend resistance."

Another optimistic user noted that Hong Kong shares of Nio rose as much as 5% on Monday and could boost the U.S.-listed stock when trading opens.

Despite CEO William Li’s December admission that Nio’s growth rate was unsatisfactory, retail traders on the platform prefer this company to rival Xpeng.

Nio stock has risen over 10% year-to-date (YTD), even as short interest increased from 7.4% to 9.5%, per Koyfin data.

Out of 27 analysts covering Nio, 15 rate it a ‘buy’ or ‘strong buy,’ 10 say ‘hold,’ and two recommend selling.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robinhood_jpg_ffd49b668a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_crypto_atm_OG_jpg_5c3f726c93.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tesla_cybertruck_resized_7ce9ec6562.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_ethereum_OG_jpg_57ba235889.webp)