Advertisement|Remove ads.

Retail Bulls Call CRISPR ‘Criminally Undervalued’ After Gene-Editing Breakthrough Cuts Cholesterol By 70%

- Phase 1 data showed CRISPR’s one-time treatment, CTX310, produced sharp, dose-dependent reductions in triglycerides and LDL cholesterol with a strong safety profile.

- The company plans to advance the therapy into Phase 1b trials targeting patients with severe lipid disorders and limited treatment options.

- Retail traders on Stocktwits said the results mark a “huge breakthrough,” with some predicting the stock could climb toward the $70–$100 range.

CRISPR Therapeutics shares drew retail attention over the weekend after the company unveiled early clinical results showing its experimental gene-editing therapy sharply reduced key blood lipids linked to heart disease.

The Swiss-U.S. biotechnology firm said on Saturday that a single infusion of its in vivo CRISPR treatment, CTX310, led to large, dose-dependent declines in triglycerides and LDL cholesterol among patients with severe lipid disorders.

Promising Early Results

Data from the Phase 1 trial showed mean reductions of 73% in ANGPTL3, 55% in triglycerides, and 49% in LDL cholesterol at the highest tested dose.

CRISPR said the therapy was well-tolerated with no treatment-related serious side effects. Among participants with elevated triglycerides above 150 mg/dL, levels fell by an average of 60% at therapeutic doses.

Chief Medical Officer Naimish Patel said the findings mark “an important milestone” for in vivo CRISPR-based therapies, showing that a single course of gene editing can safely and durably lower harmful lipid levels.

Study investigator Stephen Nicholls of Monash University called the results “unprecedented,” saying that if confirmed in larger trials, a one-time treatment could transform the approach to lifelong cholesterol management.

Next Steps For CTX310

CTX310 was studied at an early stage in patients with familial hypercholesterolemia, severe hypertriglyceridemia and mixed dyslipidemia with single intravenous doses. The treatment is planned to be advanced in a Phase 1b study to target those with the highest cardiovascular risk, where available options are limited, despite standard therapies.

The therapy is a gene editing therapy that modifies ANGPTL3, a gene that regulates triglycerides and cholesterol, using CRISPR/Cas9 technology delivered in lipid nanoparticles. Those with rare loss-of-function variants in ANGPTL3 are known to have reduced lipid levels and cardiovascular risk.

Stocktwits Bulls See ‘Criminally Undervalued’ CRISPR

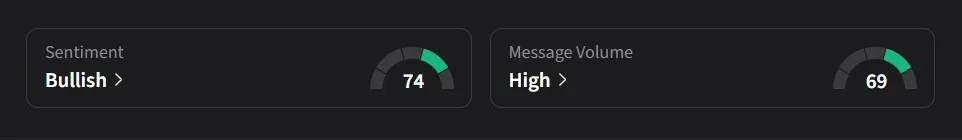

On Stocktwits, retail sentiment for CRSPR was ‘bullish’ amid ‘high’ message volume.

One user predicted that the stock would likely “pump” when markets reopen, saying the only question was how high it might go, suggesting shares could touch the mid-$60 range and close near $62, with potential to test $70 in the coming week.

Another user said the stock could “very well go to $100+” once investors fully grasp the importance of the latest clinical results, calling the data a breakthrough for the medical field.

A third user argued that CRISPR Therapeutics is “criminally undervalued,” saying the company’s steady scientific progress, plans for profitability, and its recent Sirius acquisition justify a valuation closer to $100 per share.

CRISPR’s stock has risen 40% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_39d73f48c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212776621_jpg_54c763cf43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)