Advertisement|Remove ads.

Oilfield Giants SLB, Halliburton Deliver Mixed Q2 Earnings — But Retail Investors Unswayed

Oilfield services heavyweights, SLB and Halliburton, reported earnings on Friday, with both companies meeting or exceeding analyst expectations. Despite the positive results, the market reaction diverged from retail investor sentiment.

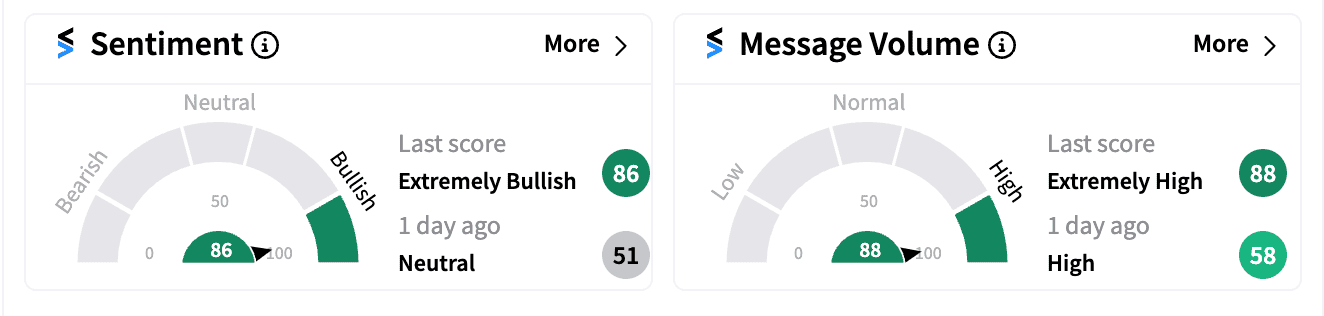

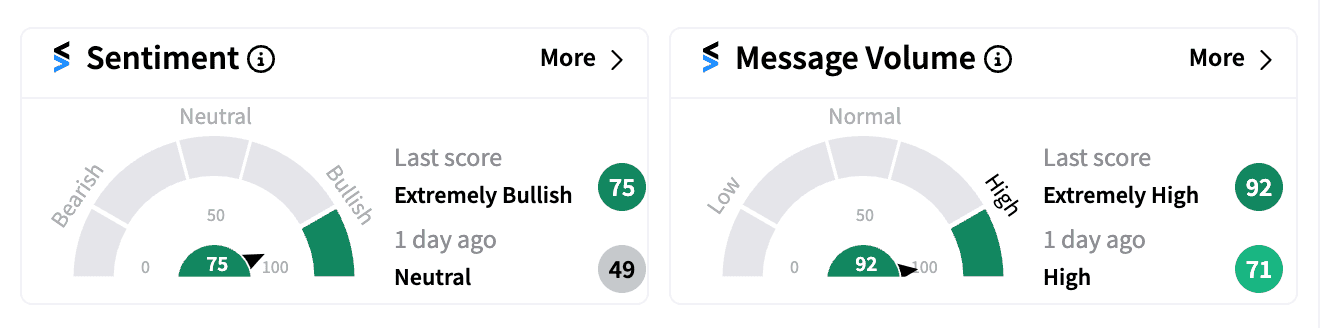

Stocktwits sentiment for both companies underwent a dramatic shift. By 10:20 AM ET, scores flipped from neutral a day ago to overwhelmingly bullish (SLB: 86/100, HAL: 75/100) with extremely high message volume.

However, the broader market seemed less convinced. HAL shares dipped over 4% to $34.91, while SLB climbed 3.50% to $50.45.

The negative response to HAL likely stemmed from missing sales estimates and a decline in U.S. and Canada sales for the fourth consecutive quarter compared to the same period last year, according to Bloomberg. Halliburton also lowered its full-year North American revenue guidance by 6-8% due to reduced activity, as reported by Reuters.

SLB, on the other hand, surpassed expectations for both revenue and EPS. This reflects the company's strategic pivot towards international and offshore projects in response to the slowdown in U.S. shale activity driven by industry consolidation, low natural gas prices, and pressure from investors to prioritize shareholder returns.

Despite the market's lukewarm response, Halliburton's Stocktwits stream buzzed with bullish posts. Many users dismissed the price drop as an overreaction, and some even saw potential long-term benefits from a potential Donald Trump re-election, echoing a similar sentiment expressed by Wolfe Research earlier this month.

SLB, with its global reach, is considered a bellwether for the overall oil and gas industry, offering insights into the sector's financial health, while Halliburton is more closely tied to activity in the U.S. shale patch.

An additional factor influencing retail sentiment could be speculation around a potential tax cut on major oil companies under a second Trump term, as suggested by an analysis earlier this year. However, the validity and impact of such a scenario remain uncertain.

While retail investors seem enthusiastic about the future of oilfield services companies, the market in this case is taking a wait-and-see approach. Both SLB and HAL are down over 3% so far this year.

/filters:format(webp)https://news.stocktwits-cdn.com/gsk_resized_jpg_00efc66e77.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_GE_Aerospace_resized_a883195e2c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_threads_resized_jpg_e588a33209.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/02/pulses-fao.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Albemarle_jpg_770d10f547.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)