Advertisement|Remove ads.

Retail Followers Of Chipotle And Mattel Brace For Tariff Commentary On Wednesday As Earnings In Spotlight

Retail investors are on the lookout for consumer stocks, including Chipotle Mexican Grill and Mattel, both of which report their quarterly earnings on Wednesday. This will provide insights into how these companies are navigating U.S. President Donald Trump’s tariff pressure.

The S&P 500 Index (SPX), which includes Chipotle, closed at a record high on Monday ahead of several tech and consumer earnings this week. Here’s a look at the two consumer companies reporting on Wednesday:

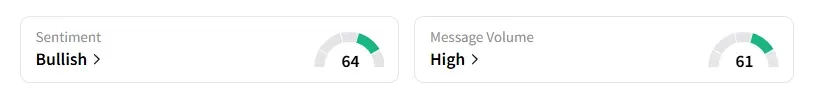

1. Chipotle Mexican Grill (CMG): Retail sentiment on the stock turned to ‘bullish’ from ‘bearish’ a day ago, with chatter levels at ‘high,’ according to Stocktwits data.

The retail user message count on Chipotle increased by 780% on Stocktwits over the last 24 hours.

Shares of Chipotle were down nearly 1% during midday trading and have lost about 14% of their value year-to-date.

A bullish user on Stocktwits said Chipotle’s stock is a long-term buy.

The company is expected to post a nearly 6% rise in second-quarter revenue to $3.12 billion, and profit per share is estimated to be $0.33, according to data compiled by Fiscal AI.

Last week, BMO Capital upgraded Chipotle to ‘Outperform’ from ‘Market Perform’ and raised the price target to $65, up from $56, according to TheFly. The brokerage believes that Chipotle is well-positioned to accelerate comparable sales growth and improve margins, beginning in the second half of 2025.

In April, Chipotle stated that the tariffs, including those on aluminum, as well as the 10% levies on most global trading partners, will impact its cost of sales by approximately 50 basis points.

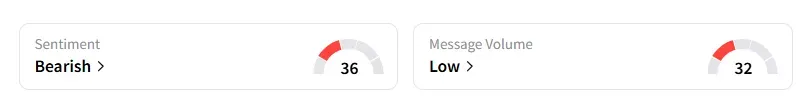

2. Mattel (MAT): Retail sentiment on the stock was unchanged and remained in the ‘bearish’ territory with ‘low’ levels of message volume, according to data from Stocktwits.

Shares of Mattel were up 1% and have gained 13% year-to-date.

In May, the toymaker withdrew its annual forecasts and announced plans to raise prices on certain products in the U.S. in an attempt to offset rising input costs resulting from broad tariffs imposed by the Trump administration.

Mattel’s second-quarter net sales are expected to decline 4.2% to $1.05 billion, and profit per share is estimated to be $0.16.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Traders Revive Kohl’s In GameStop-Like Frenzy, Stock Sees A Whopping 7,800% Jump In Retail Chatter

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203271662_jpg_17b2d32174.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264976085_jpg_5ac49235ee.webp)