Advertisement|Remove ads.

AMC CEO Breaks Silence On Shareholder Pain After Hitting Record Lows — Lays Out 2026 Plan For Profitability

- The CEO cited a prolonged industry box office slump that has kept revenues well below pre-pandemic levels.

- He said AMC expects a material box office recovery in 2026 and is positioned to benefit through improved efficiency.

- The company pointed to new revenue initiatives and continued balance sheet discipline.

AMC Entertainment CEO Adam Aron has addressed shareholder frustration following a prolonged decline in the company’s share price, saying he has personally felt the pain of AMC’s stock performance while outlining why the company believes it is positioned for profitability starting in 2026.

Aron said in a post on X that he has not sold a single AMC share since early 2022 and acknowledged widespread investor concern. He said he has largely avoided commenting on the stock price publicly on the advice of counsel due to his role at a publicly traded company.

The stock fell 0.3% in after-hours trading on Friday and ended the regular session over 3% higher, hovering near record lows at $1.61.

2026 Recovery Outlook

Aron pointed to a collapse in industry-wide box office revenues as a key factor weighing on AMC. He said domestic box office revenue in the U.S. and Canada has been stuck at between $8.7 billion and $9 billion for three years now, far below the $10 billion to $11.9 billion a year range it registered annually between 2009 and 2019.

Looking ahead, Aron said AMC believes the industry-wide box office will begin to materially recover in 2026, driven by the slate of movie releases scheduled for the year. He said the recovery could amount to hundreds of millions of dollars in additional industry revenue, with a significant portion expected to flow through to AMC’s revenue and earnings before interest, taxes, depreciation, and amortization (EBITDA) profitability given its market share.

Balance Sheet Focus

Aron said AMC has significantly improved efficiency on a per-patron basis compared with prior years, alongside continued cost reductions. He added that the company has cut debt and deferred liabilities by about $2 billion in the past five years and has kept enough cash to avoid the struggles some rivals have faced.

He cautioned that there are no guarantees and that unforeseen challenges could still emerge, but said AMC remains confident in the long-term viability of the movie theater business as it looks beyond 2026.

Stranger Things Finale Draws Big Crowds

AMC recently reported that more than 753,000 fans attended theatrical screenings of Netflix’s Stranger Things series finale across 231 AMC theaters on New Year’s Eve and New Year’s Day, generating more than $15 million through mandatory food and beverage credits.

The firm said demand led it to increase showtimes to nine times the initially planned capacity and that AMC accounted for more than half of all theatrical viewership for the occasion. Aron said AMC and Netflix had begun talks regarding the exhibition of further Netflix content in AMC theaters, as it noted that nearly two-thirds of AMC Stubs loyalty program members are Netflix subscribers.

How Did Stocktwits Users React?

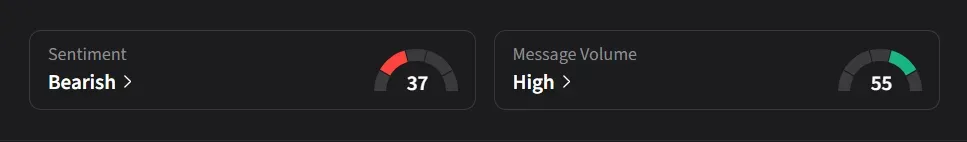

On Stocktwits, retail sentiment for AMC was ‘bearish’ amid ‘high’ message volume.

One retail investor said the CEO’s letter suggested he is aware of shareholder concerns but is limited in what he can say publicly for legal reasons, adding that long-time investors believe a turning point may be approaching.

Another retail investor urged the CEO to be more forthcoming, suggesting he disclose additional material information rather than holding back.

AMC’s stock has declined 60% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_da95861470.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233716109_jpg_230d917a7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)