Advertisement|Remove ads.

BigBear.ai Stock Slips After Hours As Debt Cleanup Brings Share Dilution Into Focus — Retail Floats Merger Talk

- The company called for the redemption of its 2029 convertible notes, with most holders expected to convert into equity.

- The move is set to cut outstanding debt while increasing the public float through new share issuance.

- The announcement follows the completion of BigBear.ai’s cash acquisition of the secure AI platform Ask Sage.

BigBear.ai shares fell in after-hours trading on Friday after the AI firm announced plans to significantly reduce its convertible debt, marking a move that will strengthen its balance sheet but also expand the company’s share count through note conversions.

Convertible Notes Called For Redemption

The company said it has issued a notice to redeem all outstanding 6% Convertible Senior Secured Notes due 2029. Noteholders have the option to convert their holdings into common stock ahead of the Jan. 16 redemption date, after which any remaining notes will be redeemed for cash at par plus accrued interest.

BigBear.ai expects to eliminate about $125 million of debt through a mix of voluntary conversions and redemptions. Around $58 million of principal had already been voluntarily converted by noteholders in 2025.

Share Issuance Weighs On After-Hours Trade

To satisfy the conversions, BigBear.ai expects to issue roughly 38 million shares of common stock that were reserved when the notes were originally issued in 2024. While the company said the process is expected to involve little to no cash outlay, preserving liquidity, the increase in public float appeared to weigh on the stock in after-hours trading.

Following the transactions, BigBear.ai expects total note-related debt to fall from about $142 million to roughly $17 million, representing the remaining balance of its convertible notes due 2026.

Deal Momentum Builds In Secure AI Markets

The announcement comes as BigBear.ai completes the $250 million cash acquisition of Ask Sage, a secure generative AI platform focused on government and regulated markets. The deal was finalized at the end of December.

Ask Sage’s technology supports AI use cases where security and compliance are paramount, and BigBear.ai expects that this expanded product set will deepen its engagement with agencies and enterprises that need AI systems capable of operating within governance frameworks.

How Did Stocktwits Users React?

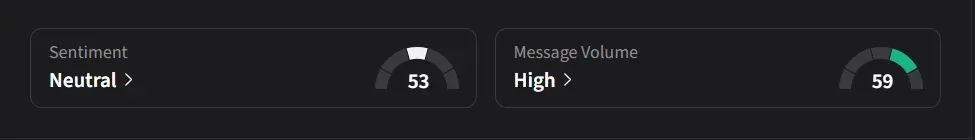

On Stocktwits, retail sentiment for BigBear.ai was ‘neutral’ amid ‘high’ message volume.

One user suggested the company could be positioning itself for a merger, adding that growth prospects for 2026 look strong.

Another user said the debt reduction move answered earlier concerns about management communication and could support stronger earnings ahead.

BigBear.ai’s stock has risen 31% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)