Advertisement|Remove ads.

Retail Traders Optimistic On Ulta Beauty Despite Price-Target Cuts

Shares of Ulta Beauty were in the spotlight on Friday as the company received several price target cuts following its fourth quarter earnings, but retail traders remained optimistic.

Ulta Beauty's Q4 earnings per share came in at $8.46, beating the estimate of $7.13, and revenue of $3.5 billion was slightly above the estimate of $3.47 billion, according to Stocktwits data.

Telsey Advisory analyst Dana Telsey lowered the price target on Ulta to $460 from $500 with an ‘Outperform’ rating, The Fly reported.

“After a challenging first half of FY24, the company has steadied itself in the second half, delivering a second consecutive quarter of better-than-expected results in Q4,” said the report citing the analyst.

According to the brokerage, the company’s store portfolio, infrastructure and omni-channel capabilities, loyalty program, and brand partnerships are ‘competitive advantages.’

Baird analyst Mark Altschwager lowered the price target to $460 from $480 with an ‘Outperform’ rating on the shares, The Fly reported, citing the brokerage’s updated model where the company is focused on reigniting momentum.

According to Loop Capital analyst Anthony Chukumba, the fourth quarter further solidified the firm's view that the "worst is behind" for the company from a competitive intrusion perspective.

For 2025, Ulta Beauty sees EPS between $22.50 and $22.90, against the consensus of $23.46.

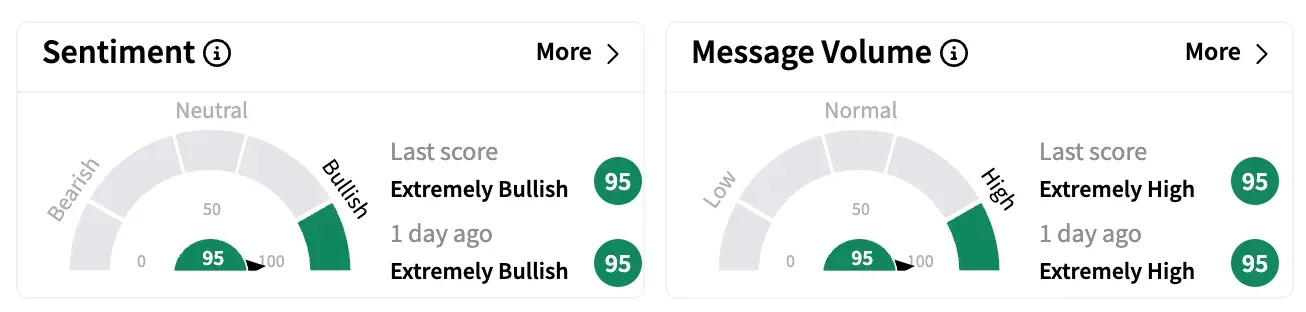

Sentiment on Stocktwits remained in the extremely bullish zone on Friday. Message volume was extremely high.

One watcher wondered if the price target cuts were aimed at taking out short investors.

Ulta Beauty stock is down 24% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Zscaler_jpg_c6a5978bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_warner_bros_discovery_wbd_resized_jpg_bae2c7edb6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Sam_Altman_1200pi_resized_jpg_a180a65511.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202831815_jpg_e9c998f956.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)