Advertisement|Remove ads.

Retail Traders Turn Bullish On Etsy Following Analyst Move Amid Macro Challenges

Shares of Etsy Inc. (ETSY) were in focus on Wednesday after the crafts retailer received a ratings initiation by JP Morgan, lifting retail sentiment.

The move comes after Etsy’s recent stock price drop to a 52-week low.

JPMorgan analyst Bryan Smilek assigned a ‘Neutral’ rating with a $50 price target, The Fly reported. JPMorgan said macro headwinds and competition are impacting Etsy’s business, but thinks its sales trends “could improve sequentially throughout 2025,” said the report.

He noted Etsy’s social commerce offering has shown improvements but its consolidated gross merchandise sales have declined year-over-year from 2022 to 2024, due to economic challenges and stiff competition.

Separately, Loop Capital analyst Laura Champine gave a ‘Sell’ rating with a $40 price target following the company's Q4 results, citing a slowdown in new buyers in Q4 in both U.S. and international markets

For the fourth-quarter, Etsy’s revenue and gross merchandise sales fell short of Wall Street estimates.

Its revenue stood at $852.16 million, missing estimates of $861.58 million. Earnings per share stood at $1.03, surpassing estimates of $0.92, according to Stocktwits data.

Etsy’s Q4 gross merchandise sales declined 6.8% year-over-year to $3.7 billion, driven by weak spending on handcrafted items and gifts. The figure was below Wall Street expectations of GMS of $3.8 billion.

Following the results, Bernstein analyst Nikhil Devnani lowered the firm's price target to $50 from $55 with a ‘Market Perform’ rating. He warned about "the uncomfortable reality" of the uncertainty of how and when Etsy may see a turnaround.

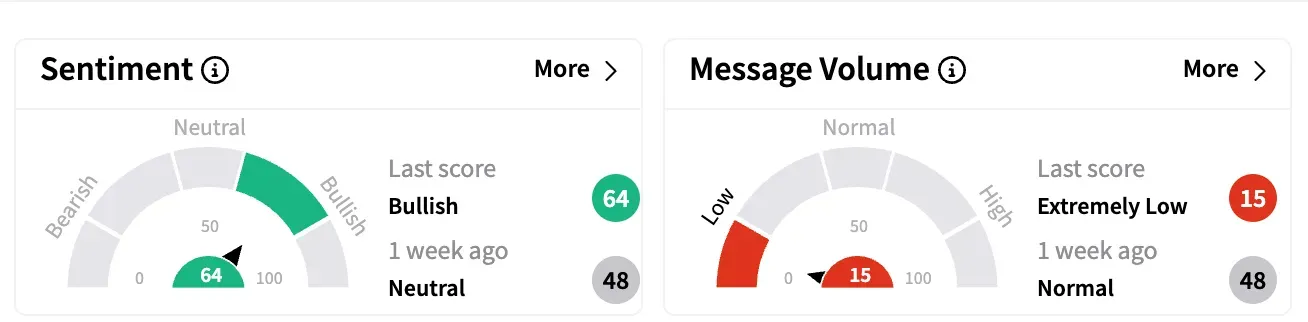

Sentiment on Stocktwits was bullish compared to neutral a week ago. Message volume was extremely low compared to normal in the same period.

One bullish watcher was adding the stock, citing its recent 52-week low.

Another trader also cited initiating a long position.

Etsy stock is down 15% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_market_OG_2_jpg_d58f0a637e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ray_dalio_resized_jpg_d2f1d535bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamie_dimon_jpmorgan_jpg_cbdd07fa63.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)