Advertisement|Remove ads.

Revolution Medicines To Get Up To $2B For Development Of Cancer Drug From Royalty Pharma

Royalty Pharma Plc. (RPRX) on Tuesday announced a $2 billion funding arrangement with Revolution Medicines (RVMD), aimed at supporting the latter’s plans for global development of its investigational cancer drug Daraxonrasib.

As per the arrangement, Royalty Pharma will provide up to $1.25 billion to Revolution Medicines in exchange for a synthetic royalty on annual worldwide net sales of Daraxonrasib for a term of 15 years and a senior secured loan of up to $750 million.

Synthetic royalty financing is a type of funding where a company sells a portion of its future revenue stream in exchange for upfront capital, without relinquishing ownership of the underlying asset.

Funds worth $1.25 billion will be awarded in five tranches upon Revolution Medicines hitting certain product development milestones. The first two $250 million tranches, totaling $500 million, are payable prior to the FDA’s approval of Daraxonrasib, and royalty obligations begin only after that.

The funds, Royalty Pharma said, will support Revolution Medicines’ plans for global development and commercialization of Daraxonrasib and its pipeline programs for patients with RAS-addicted cancers.

Daraxonrasib is an experimental drug in late-stage development for RAS mutant pancreatic cancer and non-small cell lung cancer (NSCLC). RAS is one of the most commonly mutated genes in human cancer, and the drug works by targeting RAS proteins.

In the U.S., approximately 56,000 patients are diagnosed with RAS-driven pancreatic cancer annually, while approximately 60,000 patients are diagnosed with RAS-driven NSCLC annually, Royalty Pharma said.

Revolution Medicines expects late-stage trial results for Daraxonrasib in pancreatic cancer in 2026.

Revolution Medicines CEO Mark A. Goldsmith said that the funding agreement “significantly increases” the financial resources the company can deploy.

The company had cash, cash equivalents, and marketable securities of $2.1 billion as of March 31. The company said on Tuesday that it is removing its cash runway end date guidance owing to the new funding agreement.

On Stocktwits, retail sentiment around RVMD fell from ‘bullish’ to ‘neutral’ territory over the past 24 hours while message volume increased from ‘low’ to ‘high’ levels.

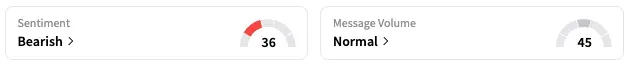

As for RPRX, retail sentiment stayed unmoved within ‘bearish’ territory over the past 24 hours while message volume improved from ‘low’ to ‘normal’ levels.

RVMD is trading nearly 2% lower on Tuesday morning.

While RVMD stock is down by about 10% this year, RPRX is up by about 41%.

Read Next: Verizon’s AI-Powered Overhaul Of Customer Support Draws Retail Praise

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_8bc1596785.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239888469_jpg_5e0e3b606c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vir_biotech_jpg_f43ff73654.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2170386387_jpg_600d460275.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)