Advertisement|Remove ads.

RIL Shares Fall Post Q1 Results: Technicals Warn Of Possible Pullback, SEBI RAs See Resistance Near ₹1,560

Reliance Industries (RIL) shares fell 2% on Monday after the company reported a mixed performance in its June quarter earnings, with growth across its core segments, including Jio Platforms and retail. But its oil-to-chemicals (O2C) vertical showed some weakness.

Analysts have highlighted that its technicals are flashing red flags. SEBI-registered analyst Rajneesh Sharma noted that the stock’s technical setup suggests caution is warranted in the near term. Smart traders may consider partial profit booking or tight trailing stops until ₹1,553 is convincingly taken out.

Earnings Fineprint

For its first-quarter (Q1 FY26), consolidated revenues rose 6% to ₹2.73 lakh crore year-on-year (YoY), and profits surged by 76.5% to ₹30,783 crore, supported by a one-time gain from the Asian Paints stake sale.

EBITDA grew sharply by 36% YoY to ₹58,024 crore, led by strong contributions from Digital Services (up 23% YoY), Retail (up 13% YoY), and Oil-to-Chemicals (O2C, up 11% YoY).

The management commentary was positive, with optimism in the digital and retail verticals, citing Jio's user base of 498 million and 20 million home connections. Additionally, the retail segment expanded its store network to 19,592, driving omnichannel presence. However, the Oil & Gas Exploration & Production (E&P) segment saw weaker earnings due to a natural decline in KG-D6 gas output, despite firm pricing.

Meanwhile, analyst Paresh Shah noted that its O2C business earnings came in below estimates, as shutdowns, inventory losses & weak petrochemicals impacted them. The retail segment saw its sharpest decline in revenue & EBITDA over the last five quarters. But Jio remains as the only stable segment, aided by subscriber growth & tariff hike (taken 4 quarters ago).

What Drove The Growth?

Retail EBITDA grew 13% YoY, while Jio Platforms posted 24% YoY EBITDA growth and a 210 basis point margin improvement. O2C EBITDA climbed 11% YoY while declining marginally QoQ on account of normalizing refining margins. Its media segment EBITDA posted a massive 261% YoY increase, driven by IPL and subscription growth.

Sharma observed that Reliance now boasts India’s largest cloud gaming platform, first mass-market UBR-based broadband tech, and 287 million IPL streaming subscribers. Retail is expanding, present across 1,000+ cities with 4,290+ pin codes, and JioMart orders are growing at 175% YoY. And its FMCG revenue doubled YoY to ₹4,400 crore, positioning them as a serious player by 2030.

Technical Caution

However, on the technical charts, Sharma noted that a bearish divergence in On-Balance Volume (OBV)—where the price reached a higher high while the OBV posted a lower high—indicates that smart money may be exiting the stock. RIL is currently testing the upper boundary of a multi-year rising channel.

He identified immediate support at ₹1,419.1, mid-term support at ₹1,300.5, and long-term support at ₹1,130.2; the short-term bias has shifted bearish due to this volume-price divergence and resistance rejection near recent highs.

Meanwhile, Shah identified support between ₹1,410 and ₹1,440, with resistance at ₹1,540 and ₹1,560. He added that near-term pressure on Reliance Industries is possible, given current technical signals.

Support and a potential reversal could emerge around the ₹1,410 level. However, if the stock closes below ₹1,380, it may face further selling pressure. On the upside, traders should watch for a breakout above ₹1,560, which could signal the start of a fresh upward move, according to Shah.

Attention now turns to the Reliance shareholders’ meeting, and commentary around the listing of the telecom unit Jio and potential price hikes in call and data charges.

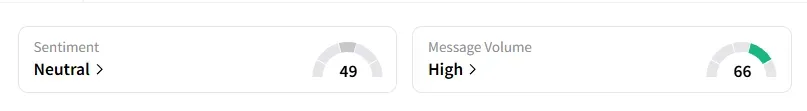

Data on Stocktwits shows that retail sentiment has moved from ‘bearish’ to ‘neutral’ amid ‘high’ message volumes.

Reliance shares have risen 19% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)