Advertisement|Remove ads.

Rio Tinto Tops 2024 Revenue Estimates As Copper Strength Cushions Iron Ore Price Slump: Retail Sees More Upside

Rio Tinto Plc. (RIO) sprung a surprise with its fiscal year 2024 revenue beating Wall Street estimates. This was despite a slump in iron ore prices, which remain the biggest profit driver for the mining giant.

Rio’s FY24 revenue came in at $53.66 billion, slightly ahead of Wall Street consensus of $53.36 billion. On the earnings front, the metals and mining company missed estimates, with an earnings per share (EPS) of $6.70, compared to an estimate of $6.82.

A slump in iron ore prices took the sheen off Rio’s earnings during the year—Rio’s earnings from iron ore declined 19% compared to 2023 despite production remaining flat. In contrast, Rio’s underlying operating earnings from its copper business rose 75%.

The weakness in Chinese demand has hurt other mining companies like BHP Billion Ltd. (BHP), too, but Rio made up for some of this decline thanks to the strength of copper, bauxite, and aluminum prices.

Overall, the company said lower iron ore prices led to a decline of $1.6 billion in its underlying earnings before interest, taxes, depreciation, and amortization (EBITDA).

“Higher prices for copper, bauxite and aluminum together with rising copper and bauxite volumes, and our focus on cost discipline helped to offset much of the impact of the iron ore price decline,” Rio said in an exchange filing.

The earnings miss aside, Rio announced a final dividend of $2.25 per share for the fiscal year 2024, down from $2.58 in the previous year.

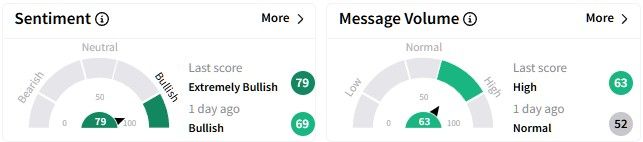

On Stocktwits, retail sentiment around the Rio Tinto stock surged notably to enter the ‘extremely bullish’ (79/100) territory from ‘bullish’ a day ago, accompanied by a surge in message volume.

One user pointed out that although Rio’s results were good, there’s not a lot of excitement around the stock.

Rio’s stock has been on an uptrend in 2025, gaining over 6.7% year-to-date (YTD.)

In contrast, its one-year performance was worse, with the stock falling 4.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137832_jpg_1de3e68131.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)