Advertisement|Remove ads.

SolarEdge Gets Price Target Hikes At BofA, JPMorgan On Improving Cash Flow Despite Q4 Earnings Miss: Retail Turns Exuberant

SolarEdge Technologies Inc. (SEDG) stock received multiple price target hikes from brokerages following its fourth-quarter earnings, even though the company missed expectations.

According to The Fly, analysts at Bank of America (BofA) Securities and JPMorgan raised their price targets for the SolarEdge stock while maintaining their existing ratings.

JPMorgan upped its price target for the SolarEdge stock to $24 from $19, implying an upside of over 22% from Wednesday’s closing price. It maintained an ‘Overweight’ rating on the stock.

The brokerage underscored that while Q4 earnings were mixed, the quarter's “strong” free cash flow should help improve investor sentiment.

It added that the earnings weakness was down to write-downs and impairment charges while noting that SolarEdge’s first-quarter (Q1) margin guidance was ahead of estimates.

SolarEdge posted a loss of $3.52 per share during Q4, much higher than estimates of a loss of $1.50 per share.

Revenue exceeded expectations – SolarEdge’s top line stood at $196.2 million, compared to an estimate of $189.3 million.

On the contrary, although BofA has increased its price target for the SolarEdge stock to $14 from $12 earlier, the brokerage is less optimistic about the company’s prospects than its peer JPMorgan.

BofA analysts note that critical challenges like demand weakness in Europe, and elevated electricity prices for U.S. residential customers continue to persist. However, it added that liquidity concerns have eased as SolarEdge generated positive free cash flows during the quarter.

BofA’s $14 price target implies a downside of nearly 29% from current levels. The brokerage has an ‘Underweight’ rating on the stock.

SolarEdge’s stock rallied post-earnings, closing the day with gains of nearly 16%. Analysts at Roth MKM had predicted the surge and hiked their price target for the stock.

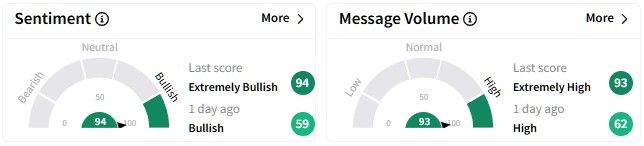

On Stocktwits, retail sentiment around the SolarEdge stock skyrocketed, entering the ‘extremely bullish’ (93/100) territory from ‘bullish’ a day ago.

Message volume also picked up as retail users discussed the stock’s price target hikes and Q4 results of the company.

The exuberance was visible in posts by users on the platform.

Despite Wednesday’s 16% surge, SolarEdge’s stock is down nearly 29% in the past six months and almost 77% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: PDF Solutions Stock Jumps Aftermarket On $130M SecureWISE Deal — Retail Sentiment Picks Up

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)