Advertisement|Remove ads.

Retail Investors Ignore RIOT Stock’s Decline To Cheer Q4 Earnings Surprise Despite Move Toward 3-Month Low

Riot Platforms’ (RIOT) stock dropped nearly 5% in pre-market trade on Tuesday, despite reporting a fourth-quarter earnings surprise as Bitcoin’s price drop dragged the shares.

The Bitcoin miner posted quarterly earnings of $1.95 per share, flipping the market’s expectation of a $0.18 loss per share, according to Stocktwits data.

Revenue came in at $142.58 million, marking a 34.2% increase from the previous year and surpassing Wall Street estimates of $135.77 million.

For 2024, Riot’s net income surged to $109.4 million, a sharp turnaround from a net loss of $49.4 million in 2023.

"These results are particularly noteworthy in the context of the Bitcoin network's 'halving' in April of 2024, and an increase in global hash rate of 67% over the course of the year,” said Riot CEO Jason Les.

He also highlighted several key growth initiatives supporting the company’s growth over the past year, including the energization of the company’s Corsicana facility and the acquisitions of Kentucky-based Block Mining and electrical engineering firm E4A Solutions.

However, Riot mined fewer Bitcoin in 2024, producing 4,828 BTC compared to 6,626 in 2023.

The company attributed the decline to a surge in mining costs, with the average cost per Bitcoin—excluding depreciation—rising to $32,216 in 2024 from $3,831 the previous year.

Mining expenses increased primarily due to a 53% reduction in power credits in 2024, compounded by April’s Bitcoin halving event and a 67% rise in the global network hash rate.

Riot also strengthened its Bitcoin holdings, acquiring an additional 5,784 BTC using proceeds from a $579 million convertible senior notes offering.

By the end of 2024, Riot held 17,722 BTC – a 141% year-over-year increase.

That number has grown to 18,221 BTC at the end of January 2025 with Riot continuing to be the third-largest publicly traded Bitcoin holder, trailing only Strategy (MSTR) and Marathon Digital Holdings (MARA), according to BitcoinTreasuries.

Looking forward, Riot reiterated its commitment to maximizing shareholder value by capitalizing on AI and HPC trends.

CEO Les previously signaled interest in AI opportunities in October, as rivals Hut 8 (HUT) and Core Scientific (CORZ) ramped up their investments in the space.

These sectors require substantial computing power, making them a natural extension for Bitcoin mining firms such as Riot and peer Cipher Mining (CIFR), which recently attracted funding from SoftBank for that goal.

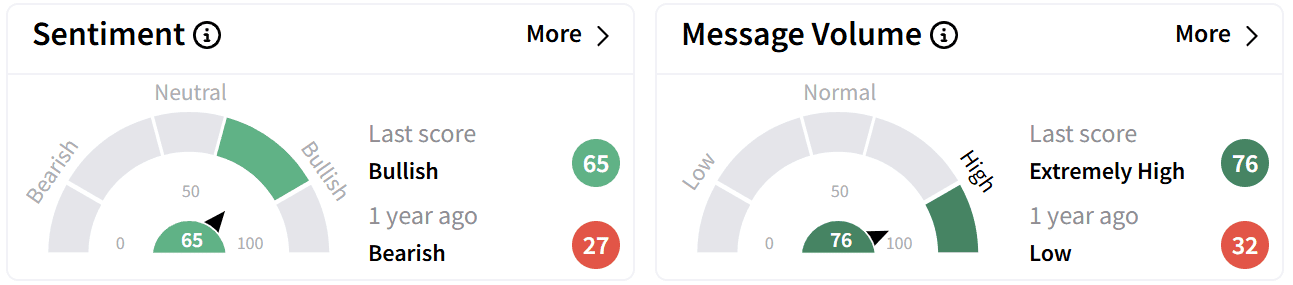

Despite the dip in Riot’s stock price, retail sentiment on Stocktwits flipped to ‘bullish’ from ‘bearish’ a day ago accompanied by chatter rising to ‘extremely high’ levels.

Investors on the platforms were largely impressed with the miner’s Q4 earnings.

One even commented that no one had seen the sell-off coming.

Bitcoin mining stocks like Riot, plunged pre-market, with the Bitcon's price falling 7% for the day, trading under $90,000.

The apex coin's crash has brought Riot’s stock to a three-month low despite posting earnings above the market’s expectations.

The stock is down nearly 5% this year and if pre-market losses hold, the decline will double.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)