Advertisement|Remove ads.

Rivian Plans ShutDown Of Illinois Plant For Three Weeks, R2 Hopes Sparks Mixed Reactions Among Retail Investors

Rivian Automotive Inc. (RIVN) on Tuesday said that starting in September, it would shut down its plant in Normal, Illinois, for three weeks as it gears up for the launch of its R2 SUV in 2026.

The R2 SUV is expected to be launched in the first half of 2026. The midsize SUV is expected to be priced around $45,000, unlike Rivian’s other consumer vehicles, which are priced over $70,000.

“R2 is a core focus for our team and a critical step to achieving our objective of delivering millions of vehicles per year,” CEO RJ Scaringe said.

The CEO said that the company is now planning to manufacture validation builds of the vehicle later this year.

Rivian plans to start manufacturing R2 in Illinois until its Georgia facility is ready, construction for which is yet to begin. The Normal facility can build up to 215,000 vehicles, and Georgia will later allow added capacity, the CEO said.

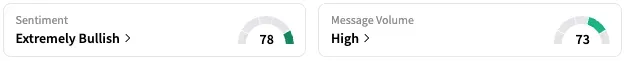

On Stocktwits, retail sentiment around Rivian jumped from ‘bearish’ to ‘extremely bullish’ territory over the past 24 hours, while message volume rose from ‘low’ to ‘high’ levels owing to a 491% jump in retail chatter.

A Stocktwits user expressed skepticism for the company, given the challenging market situation the R2 will launch into.

Another, however, expressed hopes for the R2 turning it around for the firm.

For the second quarter (Q2), Rivian produced 5,979 vehicles at its manufacturing facility in Normal, Illinois, and delivered 10,661 vehicles.

The company is aiming to deliver 40,000 to 46,000 vehicles for the full year 2025.

“We anticipate the third quarter to be our peak delivery quarter of the year across both consumer and commercial vehicles,” company CFO Claire McDonough said.

However, the company now also expects adjusted core loss in the range of $2 billion to $2.25 billion for the year, up from its previous estimate of $1.7 to $1.9 billion.

It reported Q2 total revenues of $1.30 billion, above the $1.12 billion reported in the corresponding quarter of 2024.

Adjusted loss came in at $0.80 per share, more than the $0.64 loss per share expected by analysts.

RIVN stock is down by 9% this year and by about 18% over the past 12 months.

Read also: Clear Secure Rallies As Telsey Raises Price Target On Biometric Growth, Retail Bulls Step In

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)