Advertisement|Remove ads.

Rivian Stock Rallies Premarket As $4.6B CEO Pay Package Mirrors Tesla — Retail Eyes Massive Upside

- The new 10-year pay plan grants CEO RJ Scaringe options worth up to $4.6 billion, tied to profit and share-price milestones between $40 and $140 per share, replacing a prior package deemed unattainable.

- The move comes days after Tesla shareholders approved Elon Musk’s $1 trillion compensation plan, seen by analysts as a benchmark for high-growth automakers expanding into AI and robotics.

- Retail traders on Stocktwits were upbeat, saying the R2 SUV launch and Scaringe’s performance-linked incentives position Rivian to compete more aggressively with Tesla.

Rivian Automotive shares rose over 1% in premarket trading on Monday as investors viewed the company’s new 10-year, performance-based compensation plan, worth up to $4.6 billion for CEO RJ Scaringe, as a move to retain its founder and sharpen its focus on profitability ahead of the launch of its lower-cost R2 SUV next year.

The plan, modeled after Tesla’s record-setting package for Elon Musk, ties Scaringe’s payout to new profit and stock-price targets set at lower levels than a prior award.

Details Of Revised Pay Plan

The new award grants Scaringe options to purchase 36.5 million shares of Rivian Class A stock at $15.22 per share, about 16 million more than his previous 2021 package. The earlier plan, linked to share price targets between $110 and $295, was canceled after the board determined those goals were unlikely to be met.

The new structure ties vesting to stock milestones of $40 to $140 per share over the next decade, along with new operating income and cash flow targets through 2032. If fully achieved, Rivian said shareholders could see $153 billion in value creation, while Scaringe’s potential payout could reach $4.6 billion.

Rivian also doubled Scaringe’s base salary to $2 million and said the changes were made in consultation with an independent compensation adviser “to better align pay with shareholder returns.”

Tesla’s $1 Trillion Package Sets The Benchmark

On Thursday, Tesla Inc. shareholders approved CEO Elon Musk’s $1 trillion pay package with about 75% support, reaffirming investor confidence in his leadership as the company expands further into artificial intelligence and robotics. The plan grants Musk up to 25% voting control and ties rewards to ambitious operational milestones, including growth in vehicle deliveries, autonomous systems, and robotics output.

Wedbush Securities maintained an ‘Outperform’ rating and a $600 price target, calling the decision a pivotal moment that secures leadership stability during what it described as Tesla’s “AI revolution.” The firm said the approval opens the most significant phase in Tesla’s history and bolsters its confidence in the company’s long-term trajectory.

New Pay Plan Aims To Anchor Scaringe As Rivian Prepares R2 Launch

Rivian said the new plan would help retain Scaringe and keep him focused on long-term growth and profitability as the company expands production and prepares to launch the R2 SUV, a smaller, lower-cost model positioned to compete with Tesla’s Model Y.

Separately, Scaringe was granted 1 million common units in Mind Robotics, a newly formed Rivian spinoff developing industrial AI technologies. The award provides up to a 10% economic interest once the business becomes profitable. Scaringe will serve as chair of Mind Robotics’ board, while Rivian will remain a shareholder.

Stocktwits Traders See R2 As Key To Outperform Tesla

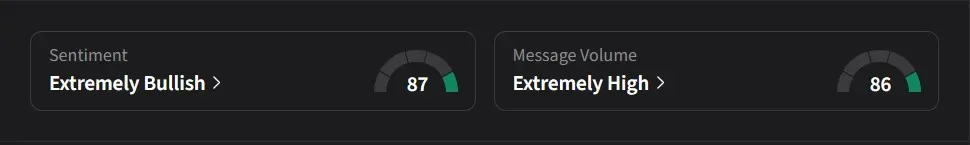

On Stocktwits, retail sentiment for Rivian was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user imagined what an internal meeting with Rivian’s leadership might sound like, suggesting the focus is now squarely on “beating Tesla” through the success of the upcoming R2 launch and by “doing everything just like Tesla” to win market share.

Another user remarked that Scaringe’s decision to personally oversee R2 marketing now “makes sense,” noting that his compensation is aligned with shareholder gains and that if he makes money, shareholders make money.

A third user pointed to Rivian’s new performance targets, tied to stock milestones reaching up to $140 per share, as a signal of management’s confidence, saying that if such levels weren’t realistic, they wouldn’t put that in writing, and expressed optimism that “this could age very well.”

Rivian’s stock has risen 15% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)