Advertisement|Remove ads.

Rivian Opens Up Sales Of Commercial EV Vans: Stock Rises But Retail Stuck In Bearish Gear

Rivian Automotive shares rose 2.7% Monday morning after the EV maker announced it is opening sales of its commercial vans to fleets of all sizes in the U.S., even as retail traders appeared to hesitate.

The Rivian Commercial Van — the platform behind Amazon's custom electric delivery van — comes in two sizes. It can carry a payload of up to 2,663 lbs and has a Gross Vehicle Weight Rating (GVWR) of up to 9,500 lbs.

Safety features include automatic emergency braking, collision warnings, and 360-degree visibility.

With Amazon's exclusivity period now over, Rivian said it has been trialing the commercial van with several large fleets and refining its fleet management process, paving the way for mass-market sales.

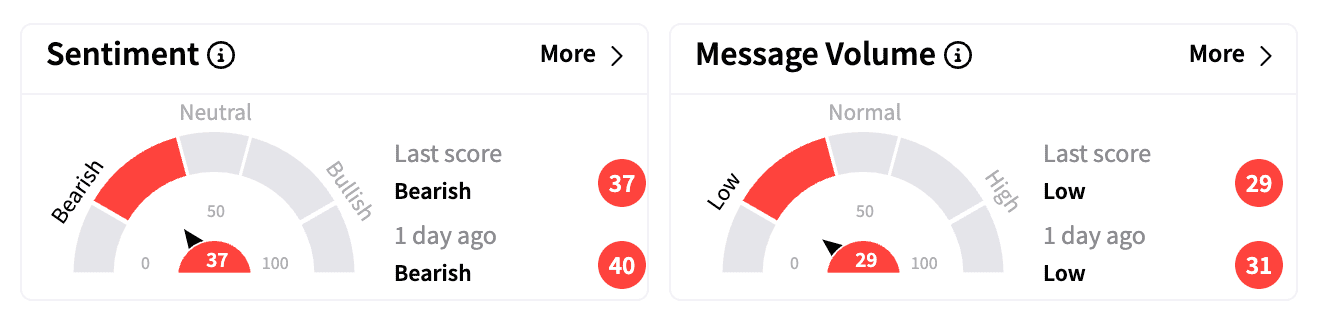

Despite the announcement, sentiment for Rivian on Stocktwits remained 'bearish,' with declining message volumes.

Retail investors expressed skepticism over weakening EV demand and held bearish expectations ahead of Rivian's fourth-quarter earnings next week.

Rivian's stock has been under pressure recently as investors worry about the impact of Donald Trump's presidency on the EV sector.

Last week, the Trump administration ordered a halt to a $5 billion federal EV charging program, an apparent sign of further policy rollbacks.

To reassure investors, Rivian CEO R.J. Scaringe posted an update in late January stating that R2 expansion is moving quickly, alongside an image of the company's Illinois plant.

Investors eagerly await updates on the upcoming, smaller, and more affordable R2 model.

Analysts remain cautious on Rivian's financial outlook. Bernstein initiated coverage on the stock last month with an 'Underperform' rating and a $6.10 price target.

The brokerage believes Rivian will successfully reach 500,000 vehicle deliveries by 2030 but warns that mid-teens gross margins won't be enough to create meaningful value for shareholders.

Bernstein estimates the company will burn $14 billion before reaching breakeven.

Rivian's short interest currently stands at 14.1%. The stock has lost more than 23% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)