Advertisement|Remove ads.

Robinhood CEO Thinks Future Investors May Laugh At Weekend Trading Breaks, Pushes Vision For 24/7 Tokenized Markets Again

- “Tokenization will unlock 24/7 markets, and once people experience it, they'll never go back. It's the same story every time: access feels impossible until it's within reach.” — Tenev.

- Earlier this year, Robinhood introduced tokenized U.S. equities and exchange-traded funds (ETFs) on Arbitrum for its European Union customers.

- Tenev said last month that the push to make it easier to trade real-world assets by linking them to blockchains will expand the addressable market from low-single-digit trillions to tens of trillions of dollars.

Robinhood Markets Inc. CEO Vlad Tenev indicated on Monday that 24/7 trading might become so popular within the next 10 years that future investors will find it difficult to believe that this wasn’t the norm earlier.

“There was a time when you couldn't trade stocks on your phone. Imagine explaining to someone in 2035 that back in 2025, markets closed on weekends and holidays,” Tenev said in a post on X. “Tokenization will unlock 24/7 markets, and once people experience it, they'll never go back. It's the same story every time: access feels impossible until it's within reach.”

Robinhood’s Tokenization Push

The retail trading platform has been rapidly expanding its offerings and intends to become a one-stop shop for customers' financial services. Tokenizing an asset involves creating a digital token and securely storing it on a digital ledger. The initiative allows assets to be traded outside market hours and is designed to increase transaction speeds. Robinhood is using tokenization to give its robust retail investor base a chance to buy shares in lucrative private firms such as OpenAI and SpaceX, and to make it easier for overseas investors to buy U.S. stocks.

Earlier this year, Robinhood introduced tokenized U.S. equities and exchange-traded funds (ETFs) on Arbitrum for its European Union customers. However, OpenAI distanced itself from the offering and warned investors before purchasing the tokens. Robinhood clarified that the underlying assets of tokens are stakes in firms, which in turn have ownership interests in firms like OpenAI.

In October, Tenev reportedly said at the Token2049 conference in Singapore that the push to make it easier to trade real-world assets by linking them to blockchains will expand the addressable market from low-single-digit trillions to tens of trillions of dollars.

Tenev told Bloomberg TV in the same conference that Tokenization “is a freight train and it’ll eat the entire financial system.” He added, “It really starts to get interesting when all of those assets, public and private, get on crypto technology.”

The company also intends to offer tokenized real estate, which could be another key driver, as noted by Cathie Wood’s Ark Investment. “Real estate represents a longer-term opportunity that Robinhood seems likely to tackle through services ranging from mortgage lead generation to tokenized property,” analysts at Ark said earlier this month.

What Are Stocktwits Users Thinking?

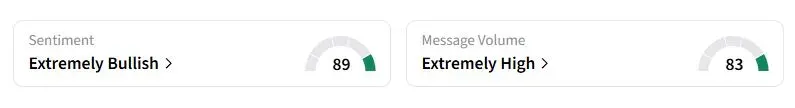

Retail sentiment on Stocktwits about Robinhood was in the ‘extremely bullish’ territory at the time of writing, while retail chatter was ‘extremely high.’

“Riding the wind to higher elevations. $150 plus by [the] New Year. As long as sentiment in [the] market remains,” one trader said.

Robinhood stock has more than tripled this year, riding on robust trading volumes amid volatility in the stock market driven by various Trump administration policies and renewed enthusiasm for digital currencies.

Also See: Why Did CleanSpark Stock Fall Nearly 4% After-Hours?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)