Advertisement|Remove ads.

Why Did CleanSpark Stock Fall Nearly 4% After-Hours?

- The company had close to 298 million outstanding shares and a market capitalization of $4.2 billion as of Monday’s close.

- The Bitcoin miner said it plans to use up to $400 million of the net proceeds from the offering to repurchase shares from investors in the convertible notes.

- It plans to use the remaining net proceeds to expand the company's power and land portfolio, develop data center infrastructure, and repay outstanding balances on its bitcoin-backed line of credit.

CleanSpark stock (CLSK) fell close to 4% in extended trading on Monday after the company said it intends to offer $1 billion worth of convertible bonds.

The company had close to 298 million outstanding shares and a market capitalization of $4.2 billion as of Monday’s close. CleanSpark also expects to grant the initial purchasers of the seven-year bonds an option to purchase up to an additional $200 million principal amount of notes, under certain conditions.

Why Does CleanSpark Want To Raise The Money?

The Bitcoin miner said it plans to use up to $400 million of the net proceeds from the offering to repurchase shares from investors in the convertible notes, and the remaining net proceeds for the expansion of the company's power and land portfolio, the development of data center infrastructure, the repayment of outstanding bitcoin-backed line of credit balances, and general corporate purposes.

Over the past few weeks, other miners, including Cipher Mining and IREN Energy, have also issued convertible bonds to raise capital for expansion into AI data centers. Like peers, CleanSpark joined the AI bandwagon by naming veteran executive Jeffrey Thomas as senior vice president of AI data centers to lead the company’s transformation.

What Are Stocktwits Users Thinking?

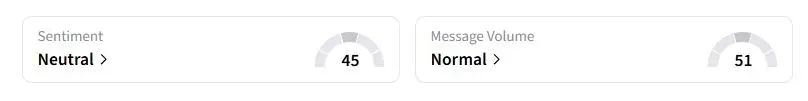

Retail sentiment on the social media platform about CleanSpark was in the ‘neutral’ territory compared with ‘extremely bearish’ a day ago at the time of writing.

“IREN and Terawulf did the same, and their share prices have rallied! This is a great move by CLSK,” one user wrote.

“Just want people to know this is not an ATM.. Dilution won't occur until 2032,” another user wrote after several users had expressed their concerns over a rumored at-the-market offering during the regular trading session.

How Did CleanSpark Stock Perform This Year?

CleanSpark stock has gained nearly 60% this year, outperforming the S&P 500 and the Nasdaq 100. However, the gains have been pale in comparison to peers Terawulf, Cipher Mining, and IREN Energy, which have risen 145%, 306%, and 483%, respectively.

CleanSpark has moved to close the gap with peers with rapidly expanding operations. It acquired 271 acres of land in Austin County, Texas. It executed long-term power supply agreements totaling 285 megawatts to support the development of a next-generation data center campus, late last month.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robinhood_jpg_ffd49b668a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_crypto_atm_OG_jpg_5c3f726c93.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tesla_cybertruck_resized_7ce9ec6562.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_ethereum_OG_jpg_57ba235889.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_transocean_OG_jpg_4d836b625f.webp)