Advertisement|Remove ads.

Robinhood Launches Tokens For EU Users To Trade US Stocks

Financial services firm Robinhood Markets Inc. (HOOD) on Monday announced an aggressive expansion into the European Union (EU) with a series of new products to simplify investing across markets.

Robinhood intends to do this with a crypto-centric, mobile-first strategy that merges tokenized stocks, perpetual futures, and staking all under one roof.

Following the news, Robinhood stock surged over 9% on Monday afternoon.

Robinhood has introduced more than 200 digital tokens representing U.S. stocks and ETFs to users in 30 European nations. These Robinhood Stock Tokens allow eligible investors to trade without paying commissions, gain access around the clock, and collect dividends through the app.

The tokens are initially hosted on the Arbitrum blockchain, but the company plans to transition them to its proprietary Layer 2 blockchain, currently in development, designed specifically for tokenizing tangible assets.

To expand its offerings for experienced investors, Robinhood has launched crypto perpetual futures across the EU. These derivatives will provide continuous market exposure with leverage options of up to 3x.

The full rollout is expected by summer's end, with trades processed through Bitstamp’s futures platform. The user interface has been built to simplify key trading actions like adjusting margin and managing positions, aiming to lower the entry barrier.

Robinhood is introducing crypto staking for Ethereum and Solana to eligible users in the U.S., following its existing availability in the EU and the European Economic Area (EEA).

The expansion allows participants to earn rewards by supporting blockchain networks. Other new features include a limited-time deposit bonus of up to 2%, intelligent order routing that lowers costs for frequent traders, and improved tax lot selection to help users manage capital gains from crypto transactions more effectively.

Later in 2025, U.S. customers will gain access to Cortex, an AI-powered investing assistant providing real-time analytics on tokens.

With these changes, the company is positioning itself to compete not just as a brokerage but as an all-in-one financial platform.

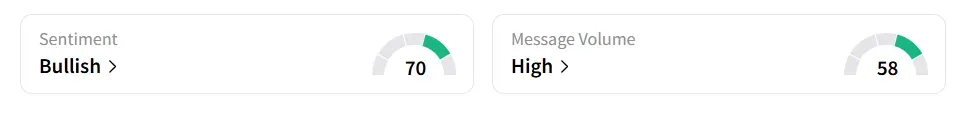

On Stocktwits, retail sentiment toward Robinhood remained in ‘bullish’ territory, and the message volume shifted to ‘high’ from ‘normal’ levels in 24 hours.

Robinhood stock has more than doubled in 2025 and more than tripled in the last 12 months.

Also See: Snapchat Sued Over Allegations Of Preying On Teens, Facilitating Criminal Behavior

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_autozone_resized_jpg_8733836467.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cigna_shares_resized_2250d1271f.jpg)