Advertisement|Remove ads.

Robinhood's Pain Deepens Amid Bitcoin Slump: Retail Traders Smell Opportunity While CEO Bets On Prediction Markets Strength

- Bitcoin has lost about $600 billion in market capitalization in November, amid concerns that the U.S. Federal Reserve might not lower interest rates at its next policymakers’ meeting.

- The top brokerages of today may see further pullbacks if their customers continue to sell crypto holdings and tech stocks tied to the artificial-intelligence trade, an analyst reportedly stated.

- Robinhood CEO Vlad Tenev said the company has seen over 1 million traders in its prediction markets and that “momentum is right.”

Robinhood stock fell by more than 5% on Monday amid declines in cryptocurrency prices and broader equity markets.

The stock has fallen nearly 21% so far in November, on track for the worst monthly drop since April 2022. The stock closed at $115.97, below its 50-day simple moving average of $132.78, according to Koyfin data.

Fading Fed Rate Cut Bets Weigh

Cryptocurrencies have lost $600 billion in market capitalization in November, amid concerns that the U.S. Federal Reserve might not lower interest rates at its next policymakers’ meeting on December 9-10, as Fed officials are cautious about a spike in inflation.

According to CME Group’s FedWatch tool, only 42% traders see a rate cut next month, compared with over 93% a month earlier. Markets are now awaiting the long-delayed September nonfarm payrolls due on Thursday after the federal government shutdown prevented the release of new data. Tech stocks have also shown signs of weakness with a growing number of bearish bets.

The top brokerages of today may see further pullbacks if their customers continue to sell crypto holdings and tech stocks tied to the artificial-intelligence trade, Owen Lamont, a portfolio manager with Acadian Asset Management, told Barron’s earlier.

Crypto Trading Volume Could Take A Hit

Earlier this month, Deutsche Bank analyst Brian Bedell warned that the firm’s crypto trading revenue could take a hit amid weak cryptocurrency prices. However, he added that the firm’s third-quarter earnings and early October metrics indicate “solid operational strength and a well-diversified business profile.”

Last week, Robinhood said its crypto notional trading volumes were $32.5 billion in October, an over 38% increase from September. Its notional equity trading volumes rose more than 34% to $320.1 billion. Robinhood’s third-quarter earnings topped estimates earlier in November, and its revenue more than doubled, primarily driven by cryptocurrency revenue.

What Are Stocktwits Users Thinking?

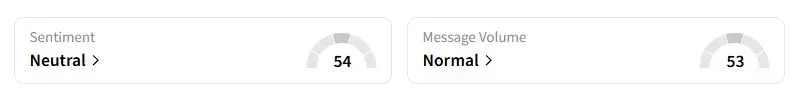

Retail sentiment on Stocktwits about Robinhood was in the ‘bullish’ territory at the time of writing, while retail chatter was ‘high.’

“With the addition of banking products, cards, and more customers, this is going to 160. This will be an established bank,” one trader said.

“I never invested in HOOD to be attached to bitcoin. I hope Vlad comes out to give us a little distance from crypto. It’s a great investment platform, but this is getting stupid,” another user said.

CEO Vlad Tenev Hails Prediction Markets' Momentum

Separately, in a post on X, Robinhood CEO Vlad Tenev said the company has seen over 1 million prediction market traders and that “momentum is right.” Bernstein analysts labeled prediction markets a viable asset class earlier this month, arguing that while they once seemed like novelty bets, they are now being integrated into the foundations of mainstream finance, backed by real capital, real users, and regulatory approval. “We are just getting started,” Tenev said.

Despite recent weakness, Robinhood stock has more than tripled this year on strong revenue growth and its inclusion in the S&P 500 index.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298117_jpg_2f7ddb9196.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Ram_83262cba1d.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)