Advertisement|Remove ads.

Robinhood’s Q4 Revenue Outlook Turns Cautious As Barclays Points To Crypto Weakness

- Barclays expects Q4 transaction revenue to come in slightly below estimates, based on December metrics.

- December trading trends were uneven, with strength in options and Bitstamp offset by weaker equities and crypto app volumes.

- Shortfall in crypto sales may be largely offset by other revenue, led by prediction markets.

Shares of Robinhood Markets Inc. (HOOD) traded lower in premarket action on Tuesday, with investor attention turning to updated views on the company’s fourth quarter (Q4) revenue trajectory.

Barclays Sees Slight Q4 Revenue Miss

In a research note, Barclays analyst Benjamin Budish said preliminary December operating metrics suggest Robinhood’s transaction revenue could come in slightly below estimates for the fourth quarter.

The analyst noted that December activity showed a recovery in options trading and volumes at Bitstamp, while equities trading declined modestly and crypto app volumes fell more sharply during the month. According to Barclays, a larger shortfall versus Q4 consensus expectations in crypto sales should be nearly offset by stronger performance in other revenue streams, primarily driven by prediction markets.

Barclays maintained an ‘Overweight’ rating on the stock and reiterated its $171 price target.

November Operating Data

The December view follows Robinhood’s November operating data, which showed mixed trends. Funded customers were 26.9 million at month-end, down about 130,000 from October due to the escheatment of nearly 280,000 low-balance accounts and excluding that impact, customers would have risen by roughly 150,000.

Total platform assets stood at $325 billion, down 5% month-on-month but up 67% year over year, while net deposits totaled $7.1 billion, implying a 25% annualized growth rate.

Trading volumes declined sequentially. Equity notional volumes fell 37% to $201.5 billion and options contracts traded dropped 28% to 193.2 million, though both were higher year-over-year.

Crypto notional volumes decreased 12% to $28.6 billion, with app-based volumes down 14% and Bitstamp down 11%, while event contracts traded rose 20% to 3 billion. Margin balances increased 2% to $16.8 billion, cash sweep balances declined 5% to $32.5 billion, and securities lending revenue was $34 million, down 43% sequentially but up 48% year over year.

Platform Expansion

In December, Robinhood expanded its tokenized asset offering, adding around 500 assets overnight and bringing its total tokenized lineup to nearly 2,000 instruments. Data showed U.S. equities accounted for roughly 73% of deployed tokens, followed by ETFs at about 24%.

How Did Stocktwits Users React?

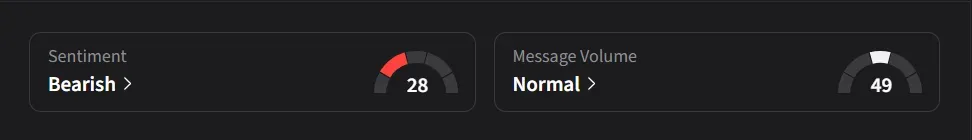

On Stocktwits, retail sentiment for Robinhood was ‘bearish’ amid ‘normal’ message volume.

Robinhood’s stock has more than tripled so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240705652_jpg_64172b74f3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)