Advertisement|Remove ads.

Robinhood Stock Rises On Significant Jump In February Operating Metrics: Retail Remains Bullish

Shares of Robinhood Markets Inc (HOOD) rose nearly 2% on Tuesday after the company reported its February operating metrics that saw a significant jump in its funded customers and assets under custody (AUC).

Funded customers in February 2025 rose 8% year over year (YoY) to 25.6 million and increased by approximately 150,000 from January.

AUC jumped 58% YoY to $187 billion but fell 8% compared to January.

Net deposits stood at $4.8 billion compared to $3.6 billion in the same period a year ago and versus $5.6 billion in January.

Robinhood reported a 77% rise in equity notional trading volumes to $142.9 billion. At the same time, crypto notional trading volumes jumped 122% YoY to $14.4 billion. Margin balances also rose at the end of February, rising 129% YoY to $8.7 billion.

Meanwhile, on Thursday, Cantor Fitzgerald initiated coverage of Robinhood with an ‘Overweight’ rating and a $69 price target.

According to TheFly, the brokerage noted that Robinhood is one of the most popular financial services platforms, particularly among younger generations.

Cantor noted that with Robinhood taking market share in equity and crypto, the stock’s risk-reward ratio is attractive at current levels despite the year-to-date rally. The market is underestimating the firm’s potential within both equities and crypto, it noted.

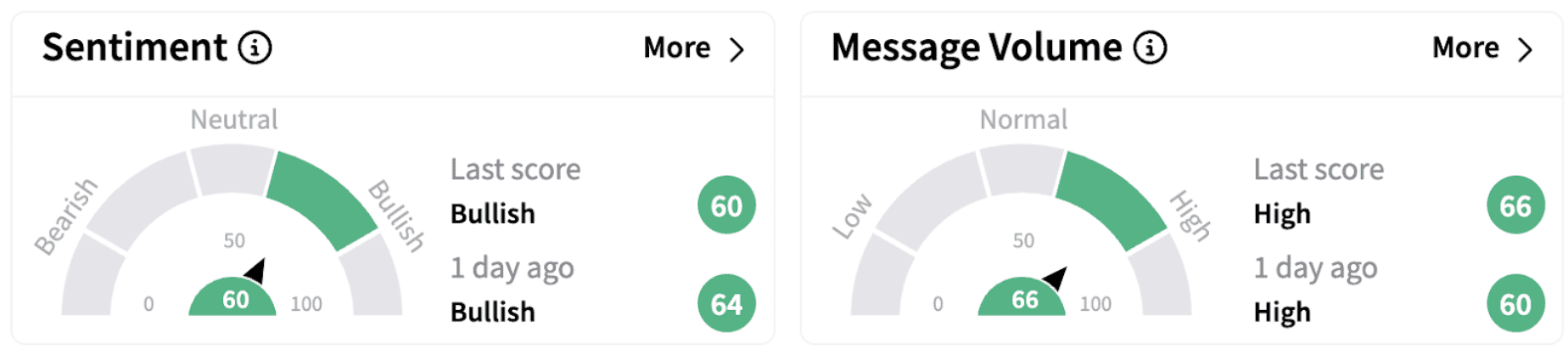

On Stocktwits, retail sentiment continued to trend in the ‘bullish’ territory (60/100), albeit with a lower score. The move was accompanied by ‘high’ levels of message volume.

One Stocktwits user expressed optimism on Robinhood’s February metrics.

HOOD shares have lost nearly 8% this year but have more than doubled over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)