Advertisement|Remove ads.

Robinhood, Strategy, Crypto Miners Take A Hit Pre-Market After Bitcoin Falls To $80K – Retail Remains Bullish

The cryptocurrency market’s weekend sell-off rippled through equity markets on Monday, dragging crypto-linked stocks in pre-market trade.

MicroStrategy (MSTR) and Coinbase (COIN) shares fell over 5% each, while bitcoin mining stocks Marathon Digital (MARA), Riot Platforms (RIOT), and Hive Digital (HIVE) declined more than 4%.

Robinhood (HOOD), which offers equities and crypto trading, suffered the steepest drop, sliding as much as 7% before the market opened.

Bitcoin fell as low as $80,123 in the last 24 hours, with leading altcoins also posting significant losses.

The downturn followed the highly anticipated White House Crypto Summit, which failed to deliver any major policy shifts. The event, coupled with the looming threat of tariffs from President Donald Trump, weighed on risk assets, including cryptocurrencies and related equities.

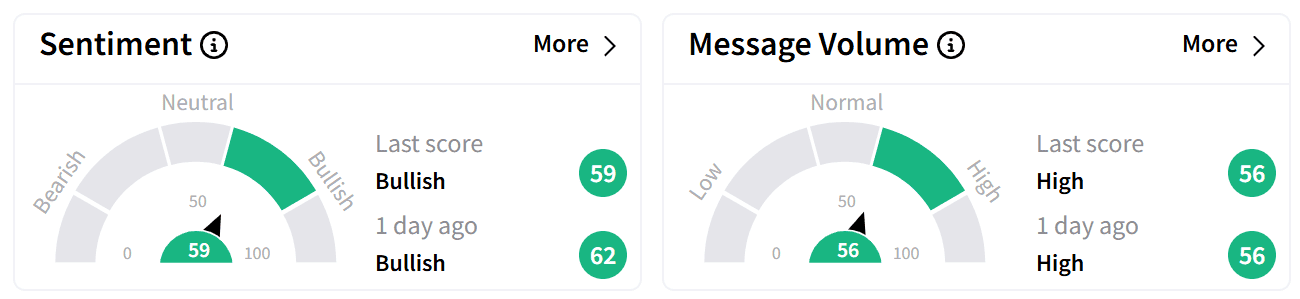

Despite the pre-market decline, retail sentiment on Stocktwits around Robinhood remained in the ‘bullish’ territory amid ‘high’ levels of chatter.

Investors noted Bitcoin’s impact on the stock, with several taking advantage of the dip to buy more.

Robinhood’s stock has gained more than 170% over the past year and trades 33% below its all-time high of $66.91, seen in January.

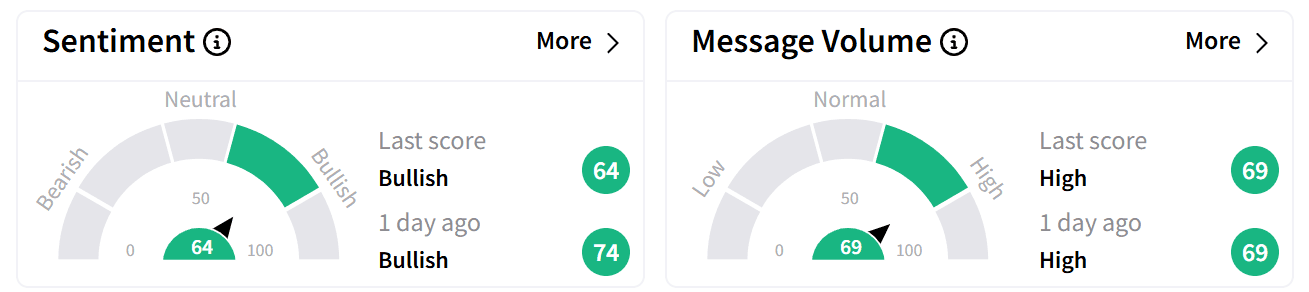

Retail sentiment around Strategy’s stock deteriorated slightly but remained in the ‘bullish’ zone, accompanied by ‘high’ levels of chatter.

Many traders questioned co-founder Michael Saylor’s strategy of accumulating more Bitcoin on the company’s dime.

Strategy is the largest corporate holder of the apex cryptocurrency. It has nearly 500,000 Bitcoin in its treasury, acquired at an average cost of $66,423 per coin, representing a 34.86% unrealized gain, according to Bitcoin Treasuries.

The stock has more than doubled over the past year compared to Bitcoin’s gains of 18.9%.

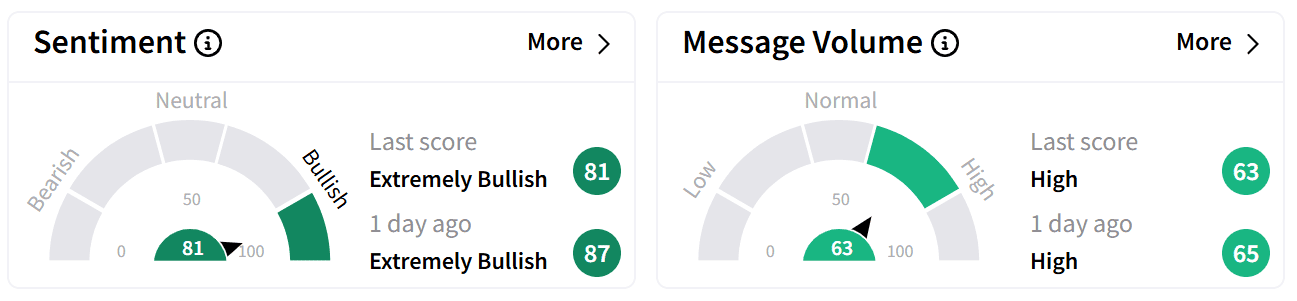

Meanwhile, retail sentiment around Marathon’s stock also saw a marginal dip but remained in the ‘extremely bullish’ territory.

One user forecast that Bitcoin is likely to fall further if the apex cryptocurrency doesn’t hold within its current price range.

Marathon is the second largest corporate holder of Bitcoin with 45,659 BTC in its coffers, valued at around $3.8 billion.

The stock is down around 27% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)