Advertisement|Remove ads.

Roblox Retail Traders Stay Bullish As JPMorgan Lifts Price Target On Surging Engagement Trends

Video game developer Roblox Corp. (RBLX) has earned a strong vote of confidence from JPMorgan as user activity on the gaming platform continues to break records.

According to TheFly, JPMorgan analyst Cory Carpenter revised the price target on the stock to $125 from $120, while maintaining an ‘Overweight’ rating, signaling increased optimism around the platform’s accelerating momentum.

Following the increase, Roblox stock inched 0.2% higher in Wednesday’s premarket.

The analyst highlighted surging engagement levels on the platform as a key factor behind the increase, with concurrent users reaching an all-time peak of 32 million and the popular experience Grow A Garden attracting 21.5 million participants on July 12.

JPMorgan now expects the gaming company’s bookings to climb 37% in the second quarter (Q2), with a projected 30% growth rate for fiscal 2025, both exceeding Roblox’s current forecasts.

The firm has also raised its broader financial expectations for Roblox in light of the platform’s accelerating growth trends.

In the first quarter (Q1), the company’s revenue rose 29% year over year (YoY) to $1.035 billion, missing the consensus estimate of $1.14 billion, as per Fiscal AI data. Bookings jumped 31% to $1.21 billion.

The gaming platform reported a loss of $0.32 per share, narrower than the year-ago loss of $0.43 and an estimated loss of $0.39.

For Q2, Roblox expects revenue of $1.020 billion to $1.045 billion, with bookings of $1.165 billion to $1.190 billion.

On Tuesday, Roblox introduced a new tool that lets developers and studios license popular characters and digital assets for use in games and experiences on its platform.

These deals will bring iconic franchises such as Stranger Things, Squid Game, Twilight, Saw, and Like A Dragon (also known as Yakuza) into the Roblox universe.

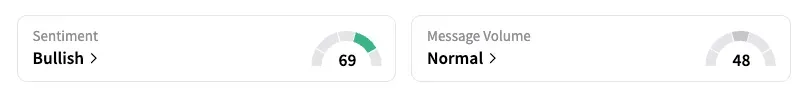

On Stocktwits, retail sentiment toward Roblox remained in ‘bullish’ territory amid ‘normal’ message volume levels.

Roblox stock has gained over 94% year-to-date and has more than doubled in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)