Advertisement|Remove ads.

Roku’s Beat And Raise Q2 Sparks Analyst Upgrades, Retail Euphoria: ‘Still The Best Value Stock On The Planet’

Streaming platform Roku Inc. (ROKU) received a fresh wave of analyst attention following its stronger-than-anticipated second-quarter (Q2) earnings and an upgraded forecast for 2025.

UBS revised its price estimate for Roku to $95 from the previous $72, while maintaining a ‘Neutral’ rating, as per TheFly.

The firm’s analyst, John Hodulik, acknowledged easing trade-related and advertising challenges as contributing factors to the higher valuation.

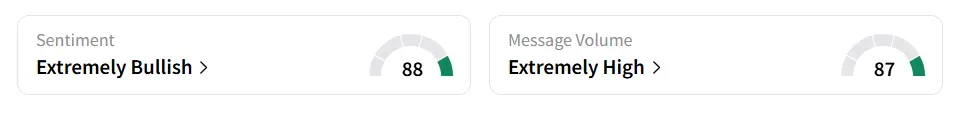

On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ (88/100) territory while message volume shifted to ‘extremely high’ (87/100) from ‘high’ levels in 24 hours.

The stock experienced a 1,433% explosion in user message count in 24 hours. A bullish Stocktwits user lauded the earnings.

Another user expressed confidence in the stock’s value, saying, ‘it’s still the best value stock on the planet.’

Roku stock traded over 5% lower in Friday’s premarket.

Despite the improvements, UBS sees a balanced risk-reward profile.

JPMorgan also adjusted its outlook, lifting its price target to $105 from $100. The brokerage reiterated its ‘Overweight’ rating, pointing to Roku’s Q2 beat and an upward revision in its guidance for the fiscal year 2025. It also emphasized Roku's robust performance in the digital ad market as a reason for the improved forecast.

KeyBanc Capital Markets took a similar stance, nudging its target price to $116 from $115, and reaffirmed its ‘Overweight’ rating. Analyst Justin Patterson noted that Roku’s advertising segment showed solid growth and highlighted the contribution of its recent Frndly TV acquisition.

Patterson sees Roku in the early stages of ad-driven growth and believes the company can maintain mid-teen revenue increases while expanding margins.

The company’s Q2 revenue climbed 15% year-on-year (YoY) to $1.11 billion, beating the analysts’ consensus estimate of $1.07 billion, as per Fiscal AI data.

Earnings per share (EPS) of $0.07 also exceeded the consensus estimate of a loss of $0.16.

Roku stock has gained over 26% in 2025 and over 70% in the last 12 months.

Also See: Palantir Gets Pooled US Army Contract Worth Upto $10B — Retail Sentiment Sours Ahead Of Q2 Results

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1449195267_jpg_c8a3db2d5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Visa_Unsplash_c5b48d0925.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_new_b2128e67d9.webp)