Advertisement|Remove ads.

Palantir Gets Pooled US Army Contract Worth Upto $10B — Retail Sentiment Sours Ahead Of Q2 Results

Palantir Technologies (PLTR) stock was down sharply in Friday’s early premarket session despite the U.S. Army announcing a new enterprise agreement with the Alex Karp-led company.

The release from the U.S. Army stated that the agreement establishes a comprehensive framework for the Army's future software and data needs. It sees the deal enhancing its readiness and driving operational efficiency while delivering significant cost efficiencies.

Palantir stock hit an intraday high of $160.89 on Thursday before pulling back and closing down 0.16% at $158.35. The stock has surged by nearly 110% this year.

Under the framework agreement, the Army consolidated 75 contracts, comprising 15 prime contracts and 60 related contracts, into a single contract. This would accelerate the delivery of proven commercial software to warfighters while removing contract and re-seller pass-through fees, it added.

The agreement establishes volume-based discounts for the contract’s performance period, which spans up to 10 years.

The Army and other Department of Defense (DoD) agencies have the option to purchase Palantir’s commercial products during that period, not to exceed a $10 billion cap.

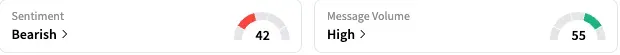

On Stocktwits, retail sentiment toward Palantir turned to ‘bearish’ (42/100) by early Friday from ‘bullish’ a day ago, with the message volume staying put at ‘high’ levels.

Retail investors were wary about the “overbought” level of the shares. One bearish watcher said that when the stock breaks below the $152 level, the “bubble will start to bust.”

Palantir is scheduled to report its second-quarter results after the market closes on Monday, with the Fiscal.ai-compiled consensus modeling adjusted earnings per share (EPS) of $0.14 and revenue of $939.47 million. This marks a significant improvement from the $0.09 and $678.13 million reported for the year-ago quarter.

In Friday’s early premarket session, Palantir stock fell 2% to $155.18.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)