Advertisement|Remove ads.

Rothschild Reportedly Downgrades Microsoft, Amazon Over Rising AI Costs

- The firm’s analysis showed that GPU deployment demands nearly six times more investment to match the value created by the original cloud infrastructure.

- Rothschild downgraded both Microsoft and Amazon to ‘neutral’ from ‘buy’.

- The firm slashed its price target on Microsoft to $500 from $560.

Rothschild & Co. has shifted its outlook on two of the biggest AI and cloud players, cutting its ratings on both Microsoft Corp. (MSFT) and Amazon.com Inc. (AMZN) to ‘neutral’ from ‘buy’.

According to a CNBC report, Analyst Alex Haissl said investors should curb expectations for generative artificial intelligence, citing higher capital costs and weaker projected returns.

Caution Over Hyperscalers

Haissl warned that the familiar narrative, “Gen-AI is just like early cloud 1.0”, is losing its credibility. The firm’s analysis showed that GPU deployment demands nearly six times more investment to match the value created by the original cloud infrastructure, skewing risk downward, according to the report.

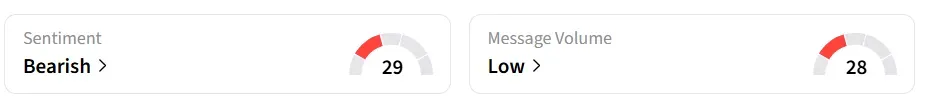

Microsoft’s stock traded over 3% lower on Tuesday, mid-morning. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘low’ message volume levels.

Amazon’s stock also traded over 3% lower. On Stocktwits, retail sentiment around the stock remained in ‘bearish territory. Message volume shifted to ‘low’ from ‘extremely low’ levels in 24 hours.

Price Targets

Rothschild slashed its price target on Microsoft to $500 from $560 and did not change its target for Amazon, keeping it at $250. While Amazon Web Services (AWS) has regained momentum, Haissl stated that Gen-AI is still hurting profitability, according to the report.

In its first-quarter earnings call, Microsoft CFO Amy Hood explained that the company is putting more money into GPUs and CPUs as demand rises and its remaining performance obligations continue to grow. Amazon raised its 2025 capital expenditure estimate to $125 billion, up from $118 billion previously.

MSFT stock has gained over 17% in the last 12 months, and AMZN stock has gained over 11% in the same period.

Also See: Why Did DGNX Stock Surge 13% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)