Advertisement|Remove ads.

Salesforce Stock Jumps After Hours As Agentforce And Data 360 Fuel Strong Q3 And Bullish Full-Year Outlook

- Q3 revenue reached $10.26 billion with adjusted earnings of $3.25 per share, topping expectations.

- cRPO grew 11% to $29.4 billion as operating cash flow and free cash flow posted double-digit gains.

- Salesforce raised its Q4 and full-year guidance, and projected revenue up 9% to 10%.

Salesforce (CRM) shares rose over 5% in after-hours on Wednesday as the software maker reported third quarter (Q3) results that topped Wall Street expectations, and raised its outlook, citing strong demand for its Agentforce and Data 360 products.

Q3 Review

Revenue rose 9% from a year earlier to $10.26 billion, compared with the consensus of $10.27 billion. Adjusted earnings reached $3.25 per share, ahead of expectations for $2.86.

Current remaining performance obligation (cRPO) grew 11% to $29.4 billion, and total Remaining performance obligation (RPO) rose 12% to $59.5 billion. Subscription and support revenue increased 10% to $9.7 billion.

Operating cash flow climbed 17% to $2.3 billion, and free cash flow improved 22% to $2.2 billion. The company returned $4.2 billion to shareholders through buybacks and dividends.

Agentforce And Data 360 Power Growth

CEO Marc Benioff said Q3 cRPO performance “signaled a powerful pipeline of future revenue,” highlighting the strength of Agentforce and Data 360, which together reached nearly $1.4 billion in annual recurring revenue (ARR), up 114% year on year.

Agentforce processed more than 3.2 trillion tokens, closed over 9,500 paid deals, and posted a 330% increase in ARR. Data 360 ingested 32 trillion records, up 119% year on year, including gains in Zero Copy and unstructured data processing. Benioff said the platforms underscored Salesforce’s leadership in building the “Agentic Enterprise.”

CFO Robin Washington said Agentforce adoption and Q3 momentum supported Salesforce’s path toward its $60 billion-plus organic revenue target and its profitability target for FY30.

Guidance Raised For Q4 And Full Year

Salesforce guided to fourth quarter revenue of $11.13 billion to $11.23 billion, above analyst expectations of $10.9 billion. The company projected adjusted earnings of $3.02 to $3.04 per share, compared with the consensus of $3.04, and said it expects cRPO growth of about 15%.

For fiscal 2026, Salesforce raised its revenue forecast to $41.45 billion to $41.55 billion, representing 9% to 10% growth, and maintained adjusted operating margin guidance of 34.1%. The company also increased its full-year operating cash flow growth outlook to 13% to 14%.

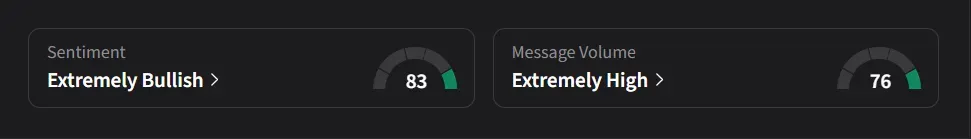

Stocktwits Traders Expect Post-Earnings Jump

On Stocktwits, retail sentiment for Salesforce was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said the stock “will pop” during the earnings call and urged patience.

Another user said CRM “Looks like a strong long into tomorrow with stop at $241.”

Salesforce’s stock has declined 28% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_justin_sun_resized_jpg_80141eb4e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_hq_resized_af4cc05fd5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)