Advertisement|Remove ads.

Sandisk Shares Are Surging Again After 648% Rise In Six Months — Why Is Retail Still Bullish?

- A TrendForce report forecasts NAND Flash prices will jump up to 38% in the upcoming quarter while contract prices for client SSDs are expected to increase by at least 40%.

- At the 2026 Consumer Electronics Show (CES), Sandisk announced the rebranding of its high-performance lines, the Sandisk Optimus SSD brand, for gamers, creators, and enterprise AI workloads.

- Sandisk has an active engagement with five major hyperscale customers, with two hyperscalers in qualification, a third hyperscaler and top storage OEM planned for CY26.

Shares of Sandisk Corp. (SNDK) rallied over 23% on Tuesday morning after gaining over 648% in the past six months. Despite the stock’s steep run-up, retail investors are still firmly bullish on the stock.

The increasing optimism comes amid growing demand for artificial intelligence, data center deployments, and memory chips even as a global supply shortage is boosting Dynamic Random Access Memory (DRAM) and NAND Flash prices.

Retail traders are eyeing Sandisk’s memory chip capabilities and growing AI infrastructure.

Leg-Up From SSDs

A TrendForce report released on Jan. 5 2026 forecasted that conventional DRAM contract prices in the first quarter (Q1) of the year will rise up to 60% quarter-on-quarter. The firm expects NAND Flash prices to jump up to 38% in the same period while contract prices for client SSDs are expected to increase by at least 40%.

Sandisk’s Solid-State Drives (SSD) are powering AI workloads through enterprise storage. At the 2026 Consumer Electronics Show (CES), Sandisk announced the rebranding of its high-performance lines, launching the Sandisk Optimus SSD brand. The move streamlines its WD BLACK and WD Blue brands into the new one for gamers, creators, and enterprise AI workloads to deliver superior performance leadership and engineering in its flash memory.

In its latest quarterly report, Sandisk said that it has an active engagement with five major hyperscale customers. The company’s datacenter revenue was up 26% sequentially, with two hyperscalers in qualification, a third hyperscaler and top storage OEM planned for CY26, it said.

In addition, the company’s BiCS8 technology, an advanced 3D NAND flash memory technology, accounted for 15% of total bits shipped in the latest quarter and is expected to reach majority of bit production by the end of fiscal year 2026.

Additionally, Nvidia's Chief Executive Officer Jensen Huang highlighted the potential of the storage market in his keynote speech at CES 2026 on Monday, saying it is a completely unserved market that will likely be the largest storage market in the world, holding the working memory of the world’s AIs.

What Are Stocktwits Users Saying?

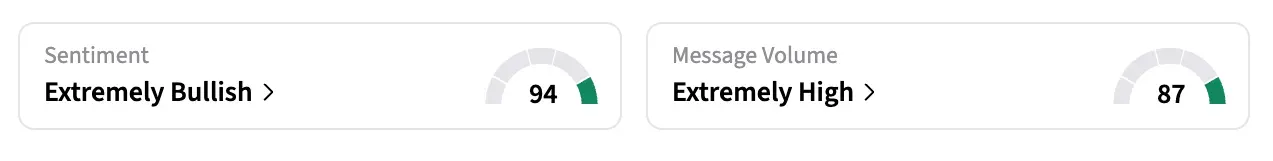

On Stocktwits, retail sentiment around Sandisk stock stayed at ‘extremely bullish’ territory over the past day amid ‘extremely high’ message volumes.

One bullish user said the company’s memory chips and AI warrant a buy.

Another user said that the company is now leading the new AI economy.

A third user noted that the prices of SSDs are rising and may not stop anytime soon.

Shares of SNDK were among the top trending tickers on Stocktwits at the time of writing and have gained over 840% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219715394_jpg_c787a7b591.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_martin_shkreli_jpg_4da92d4843.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)