Advertisement|Remove ads.

Sarda Energy Near Key Support: SEBI RA Flags Tactical Breakout Opportunity Above ₹445

Sarda Energy & Minerals has remained within a short-term downtrend, with the stock declining 6% over the last month.

But it is now approaching key support near ₹425–₹430. SEBI-registered analyst Vijay Kumar Gupta believes that it is shaping up as a tactical range play, with a breakout strategy in place. He is watching for a reversal or breakdown from the current levels.

Gupta identified resistance between ₹444 and ₹445, with a descending trendline from the April highs capping rallies. A break above ₹445, accompanied by volumes, is necessary to shift the structure.

Immediate support is seen between ₹ 428 and ₹ 430, a level that has seen recent lows bounce her. A decisive hold with bullish candles could trigger a short-term swing, he added. The next support is seen at ₹420, which was a previous consolidation area. And a failure to hold ₹430 may lead to a retest of this zone.

Gupta noted that ₹405–₹410 is a major demand zone for Sarda Energy, since it is a longer-term support area. If the stock manages to hold at these levels, it could indicate a deeper structural stability. On the upside, he pegged targets at ₹445–₹450, if the stock breaks the trendline on volume and flips ₹ 430 into support.

On the volume front, Gupta observed that the stock has seen minor buying and very little selling, which suggests that a short-term pause is likely; an upside breakout should come with increased volume to confirm legitimacy.

Tactical Play Setup

Gupta suggests traders wait for a bullish candle near ₹430–₹428 to trigger a short-term long target of ₹445. Any break below ₹428 opens the path to ₹420, and lower supports come into focus. On the other hand, a strong close above ₹445–₹450 on volume will confirm a reversal, opening the door to higher targets.

He concluded that Sarda is currently trading in a structured range, with near-term bulls likely to provide support. At the same time, a breakout above downtrend resistance would signal a shift toward a broader recovery. Patience and level discipline will be key for the next moves.

In recent news, the company received consent from the Chhattisgarh Environment Conservation Board to operate a coal gasifier plant for a pellet plant in Raipur. Additionally, its subsidiary has commenced commercial operations at its hydroelectric power project in Chhattisgarh.

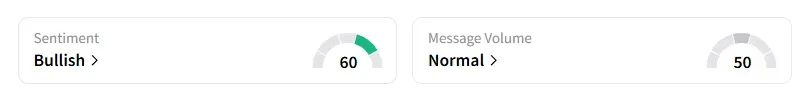

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter.

Sarda Energy shares have fallen 12% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)