Advertisement|Remove ads.

Spirit Airlines Stock Rallies 36% Pre-Market Following Reports Of Frontier Merger Discussions: Retail Cautiously Optimistic

Shares of Spirit Airlines Inc ($SAVE) skyrocketed by as much as 36% before markets opened on Wednesday after reports indicated Frontier Airlines ($ULCC) has rekindled its interest in a merger with the carrier.

Frontier’s stock also jumped by nearly 7% in pre-market trading on Wednesday.

According to the Wall Street Journal, the two airlines have recently engaged in early-stage discussions about a potential merger. If an agreement is reached, it would likely coincide with Spirit's efforts to restructure its debt and liabilities during bankruptcy proceedings.

Frontier and Spirit have had a long history of on-and-off merger discussions since 2016. They came closest to a deal in 2022 when Frontier agreed to acquire Spirit in a $2.9 billion transaction. However, JetBlue Airways Corporation ($JBLU) intervened with a competing offer that ultimately swayed Spirit investors.

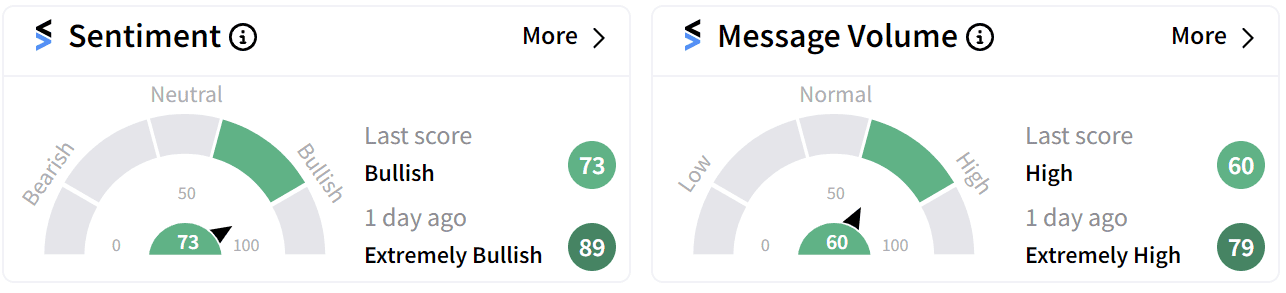

Despite the massive uptick in Spirit’s share price, retail sentiment on Stocktwits has dipped to ‘bullish’ (73/100) from ‘extremely bullish’ a day ago.

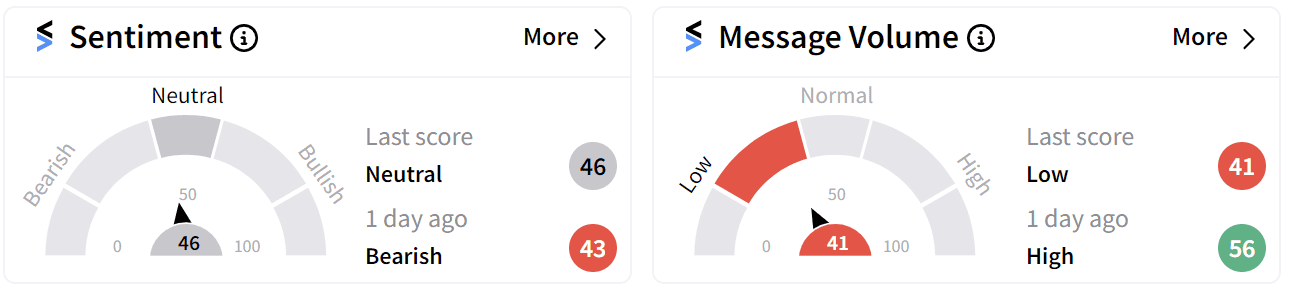

Meanwhile, retail sentiment around Frontier has improved to ‘neutral’ (46/100) from ‘bearish’ a day ago.

Spirit has faced significant financial challenges after a failed merger with JetBlue and years of operating losses.

However, the airline received some relief last week after it secured a deal with its credit card processor to extend the deadline for refinancing its debt. Spirit must refinance $1.1 billion in bonds by late December to avoid jeopardizing its credit card processing capabilities in the upcoming year.

In its attempt to revamp the business, Spirit is shifting toward a more premium approach, enhancing its basic offerings with upgraded ticket packages. The company’s executives believe this new direction will attract high-spending travelers, fend off increasing competition, and boost revenue.

Spirit’s stock is currently trading at all-time lows, having lost 84% of its value so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

Read more: Archer, Joby Stocks Surge As FAA Finalizes Air Taxi Rules: Retail Sentiment Reaches New Highs

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_92efa5a8c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Visa_resized_82d951e81e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1218279776_jpg_d381694a09.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199360480_jpg_41abd97106.webp)