Advertisement|Remove ads.

Scale AI Reportedly Slashes Workforce After Meta Deal, But Retail Keeps Neutral Ground

Meta Platforms Inc.(META) backed Scale AI is reportedly making deep cuts to its workforce, laying off hundreds of employees in a move to slim down its data-labeling division.

According to a Bloomberg report, Scale has dismissed 200 full-time staff members, representing approximately 14% of its global workforce.

Additionally, the company will discontinue its work with 500 contract workers. The move is intended to streamline the organization and enhance its operational efficiency.

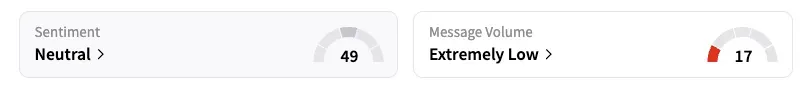

On Stocktwits, retail sentiment toward Scale AI remained in ‘neutral’ territory with ‘extremely low’ retail chatter levels.

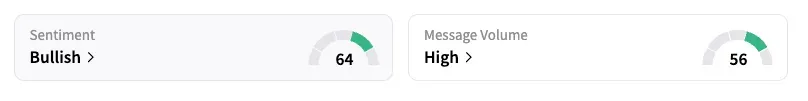

Following the report, Meta Platforms stock inched 0.9% lower on Wednesday afternoon. But retail sentiment improved to ‘bullish’ (64/100) from ‘neutral’ territory amid ‘high’ (56/100) message volume levels.

Meta had recently invested $14.3 billion in the company, acquiring a 49% stake, and hired away its co-founder and CEO, Alexandr Wang.

Interim CEO Jason Droege explained that the job cuts stemmed from rapid hiring and increased structural complexity during a period of fast growth. In a message to employees, he noted that the data-labeling division had expanded too quickly, resulting in workflow issues and a lack of clarity across teams, according to the report.

Droege also pointed to evolving market conditions and changing customer requirements as major drivers of the decision.

After Meta’s investment, Scale’s high-profile clients, such as OpenAI and Alphabet Inc. (GOOGL), have allegedly scaled back or cut ties with the company due to fears that Meta could gain visibility into their sensitive AI development efforts.

Even with these challenges, Scale expects a 2025 revenue of about $2 billion, from its $870 million revenue in 2024. The company is likely to shift its focus toward more lucrative labeling efforts tied to programming, speech, and linguistic data.

Meta Platforms' stock has gained only 0.3% since Scale AI confirmed the tech giant’s stake. But the stock has gained over 43% in the last 12 months.

Also See: Google’s Pixel 10 Event Draws Retail Cheer As It Promises Foldable AI Phones And Smartwatch

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)