Advertisement|Remove ads.

Small-Cap Scilex Drew Biggest Jump In Retail Following For July: What Drove It?

Scilex Holding Co. (SCLX), a relatively under-the-radar player in the non-opioid pain management space, has unexpectedly captured the attention of retail investors. The company experienced a staggering 41.78% increase in retail followers on Stocktwits over the past month, despite a 21% decline in its share price.

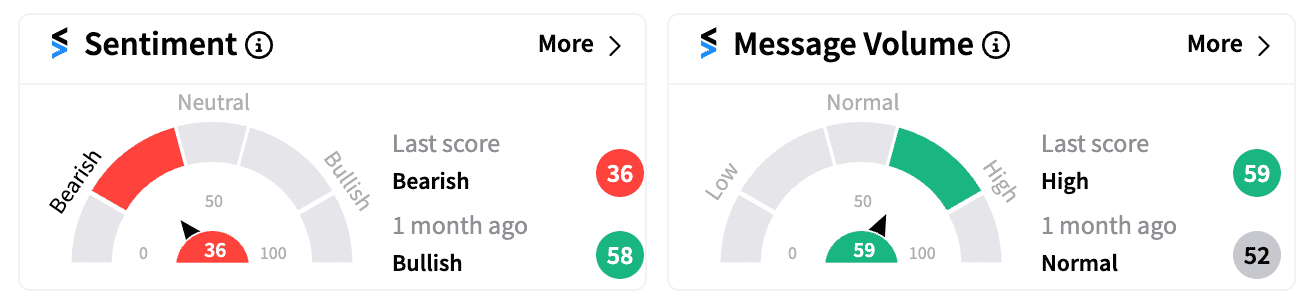

However, the initial bullish sentiment has waned, with Stocktwits sentiment flipping to bearish (36/100) and message volumes surging. This shift suggests growing investor skepticism amidst recent company developments.

The surge in retail interest can be attributed to several factors. Primarily, the announcement of a potential $2 billion deal for its subsidiary, Semnur Pharmaceuticals, to go public through a SPAC merger with Denali Capital Acquisition Corp (DECA) has generated excitement. The proceeds from this deal are earmarked for the development of SP-102, a key drug candidate in late-stage trials.

Additionally, Scilex had reported preliminary Q2 net sales above estimates, indicating revenue growth. However, a significant decline in cash and cash equivalents raised concerns.

The company also entered into a collaboration agreement with ACEA for the potential expansion of its ZTlido treatment, used to help relieve nerve pain after shingles, in the Greater China region.

While July saw continued sales growth for ZTlido, the pace of growth slowed compared to the previous month. This, coupled with the overall bearish sentiment and declining cash reserves, seems to have tempered initial enthusiasm.

With Q2 earnings report scheduled for August 9th after market hours, investors will be closely watching for further clarity on the company's financial health and the progress of its key initiatives.

Photo via Vecteezy

/filters:format(webp)https://news.stocktwits-cdn.com/large_nintendo_switch_2_jpg_bccd766d3b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245602336_jpg_dcf0764466.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_3_jpg_3ea694b5e1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240006388_jpg_320990af67.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)