Advertisement|Remove ads.

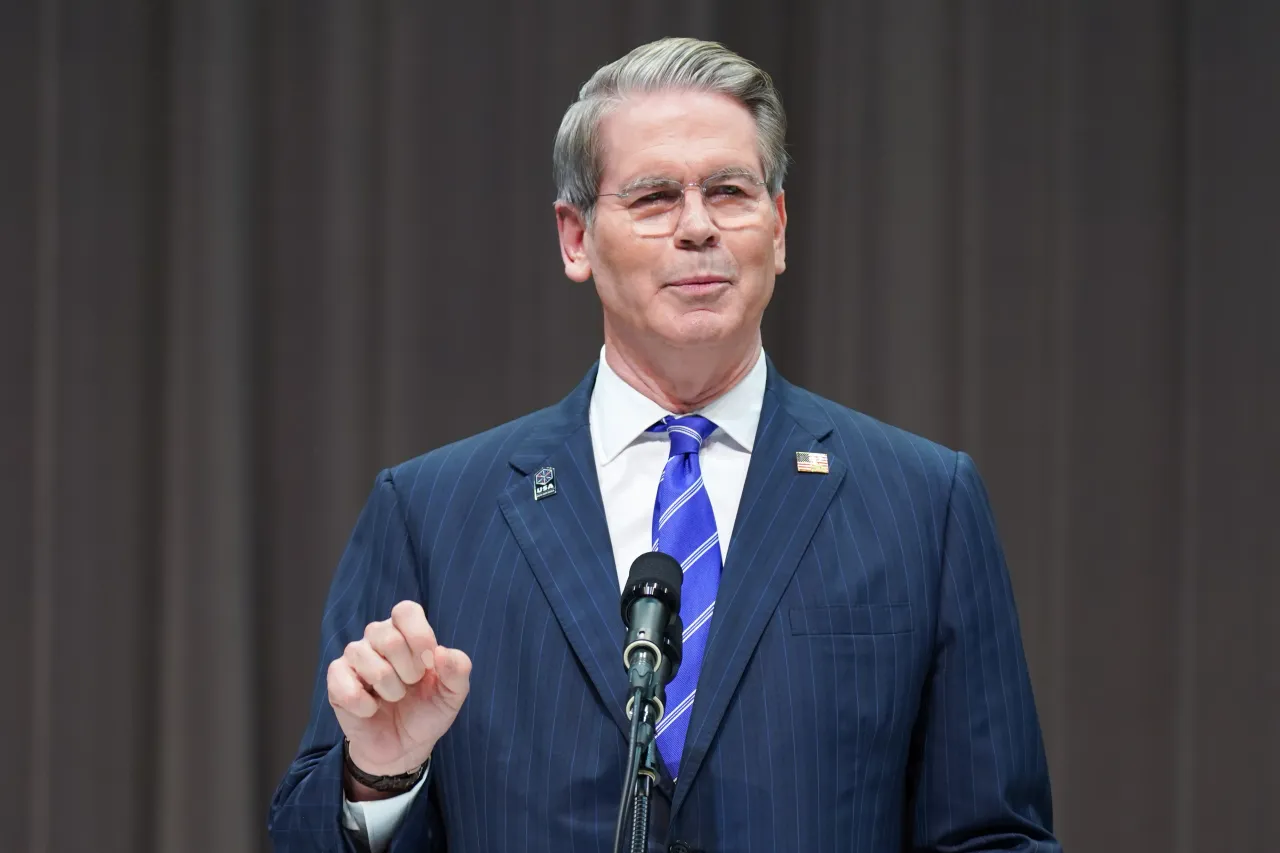

Scott Bessent Says US Has ‘Things That Are More Powerful’ Than China’s Rare Earth Export Controls: Report

Treasury Secretary Scott Bessent reportedly stated that while the U.S. does not want to decouple from China, it has the capability to respond with “things that are more powerful” than the Chinese government’s rare earth export controls.

Speaking during an interview with CNBC, Bessent framed the ongoing U.S.-China trade tensions as a “China versus the world” issue. “This is something that they were clearly planning all along. I think that things can de-escalate, we don’t want to have to escalate,” said Bessent.

The Treasury Secretary added that he will be meeting with European allies, Australia, Canada, India, and Asian democracies. “We’re going to have a fulsome group response to this, because bureaucrats in China cannot manage the supply chain or the manufacturing process for the rest of the world,” he said.

Elaborating on what the “fulsome” response would be like, Bessent said the U.S. has lots of levers it can pull for products that China needs that could be “equally damaging” for the latter. “They’re a command and control economy, but they are neither going to command, nor control us,” Bessent added.

The Treasury Secretary maintained that the U.S. does not want to decouple from China, while adding that the Trump administration won’t negotiate with China “because the stock market is going down.”

Meanwhile, U.S. equities rose in Wednesday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up 0.78%, the Invesco QQQ Trust ETF (QQQ) surged 0.81%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) gained 0.58%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was up 0.09% at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)