Advertisement|Remove ads.

Workhorse Stock Jumps Ahead Of Motiv Merger Vote — Board Warns Stake Could Be Worth ‘Little Or No Value’ Without Support

- Workhorse said the Motiv merger requires shareholder approval across all proposals, even though early voting shows strong support.

- Proxy advisors ISS and Glass Lewis recommended voting for the transaction.

- Stocktwits traders debated the merger’s potential, with some highlighting 2026 delivery and revenue upside while others questioned whether the gains are already priced in.

Workhorse Group shares rose sharply on Monday as investors showed renewed optimism ahead of the company’s high-stakes AGM on Tuesday, where shareholders will decide whether to approve its proposed all-stock merger with Motiv Electric Trucks.

The stock closed up 13% at $0.99 on Monday and added 2% in after-hours trading.

The company has intensified its push for investor support, warning that failing to vote in favor of the deal could leave shareholders’ investments at risk.

Company Urges Shareholders To Vote FOR Merger

Workhorse told investors that, while votes cast so far show strong support for the combination, the transaction cannot close unless shareholders actively vote FOR all the merger-related proposals. In a letter earlier this month, the company reiterated that failing to approve the deal would force Workhorse to continue independently, a path it said could include a restructuring that “would likely result in your Workhorse investment having little or no value.”

What The Motiv Merger Would Do

Under the terms of the all-stock transaction, Motiv will be merged into a newly created Workhorse subsidiary, with Motiv investors initially receiving approximately 62.5% of the combined company. Existing Workhorse shareholders would retain about 26.5% ownership. Workhorse said the structure is designed to stabilize the business, strengthen liquidity, and position the combined company to better compete in the medium-duty EV commercial vehicle segment.

The merger also builds on prior financing steps as Workhorse has already received $25 million from entities affiliated with Motiv’s controlling investor to support near-term operations and debt reduction. At closing, the combined company is expected to gain access to up to $20 million in additional financing, with further capital raises anticipated after the merger is completed.

Workhorse said the combined enterprise would gain a broader product lineup, improved scale to reduce unit costs, access to a larger base of blue-chip customers, and at least $20 million in potential cost synergies by the end of 2026 across R&D, G&A, and facilities.

ISS And Glass Lewis Back The Deal

Proxy advisors Institutional Shareholder Services (ISS) and Glass Lewis have both recommended that investors vote FOR the merger. In its report, ISS said “the transaction warrants support in light of the compelling strategic rationale and the board's reasonably thorough review of alternatives.”

The firm highlighted the complementary nature of Workhorse and Motiv’s businesses, projected scale benefits, and the view that greater value could be realized from the merger than from a liquidation or other bankruptcy process. Glass Lewis similarly recommended voting for the deal.

Why The Vote Matters

Workhorse said the merger with Motiv would help the combined company capture new growth opportunities in the over $23 billion medium-duty trucking market. The company highlighted Motiv’s diverse product portfolio and top fleet relationships alongside Workhorse’s proven vehicles, manufacturing capabilities, and national dealer network, and said the combination is intended to deliver long-term shareholder value.

Stocktwits Bulls Eye 2026 Growth

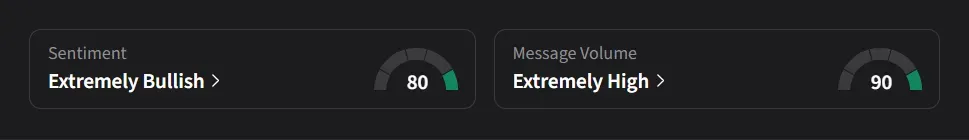

On Stocktwits, retail sentiment for Workhorse was ‘extremely bullish’ amid a 7,600% surge in 24-hour message volume.

One user said they see a bullish setup in which the combined company could deliver 100 to 150 trucks in 2026, generating roughly $30 million to $50 million in revenue.

Another user said they remain cautious, arguing that if the post-merger upside were that clear, the stock would already reflect it and shorts wouldn’t be waiting until the announcement to start covering.

Workhorse Group’s stock has declined 89% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)