Advertisement|Remove ads.

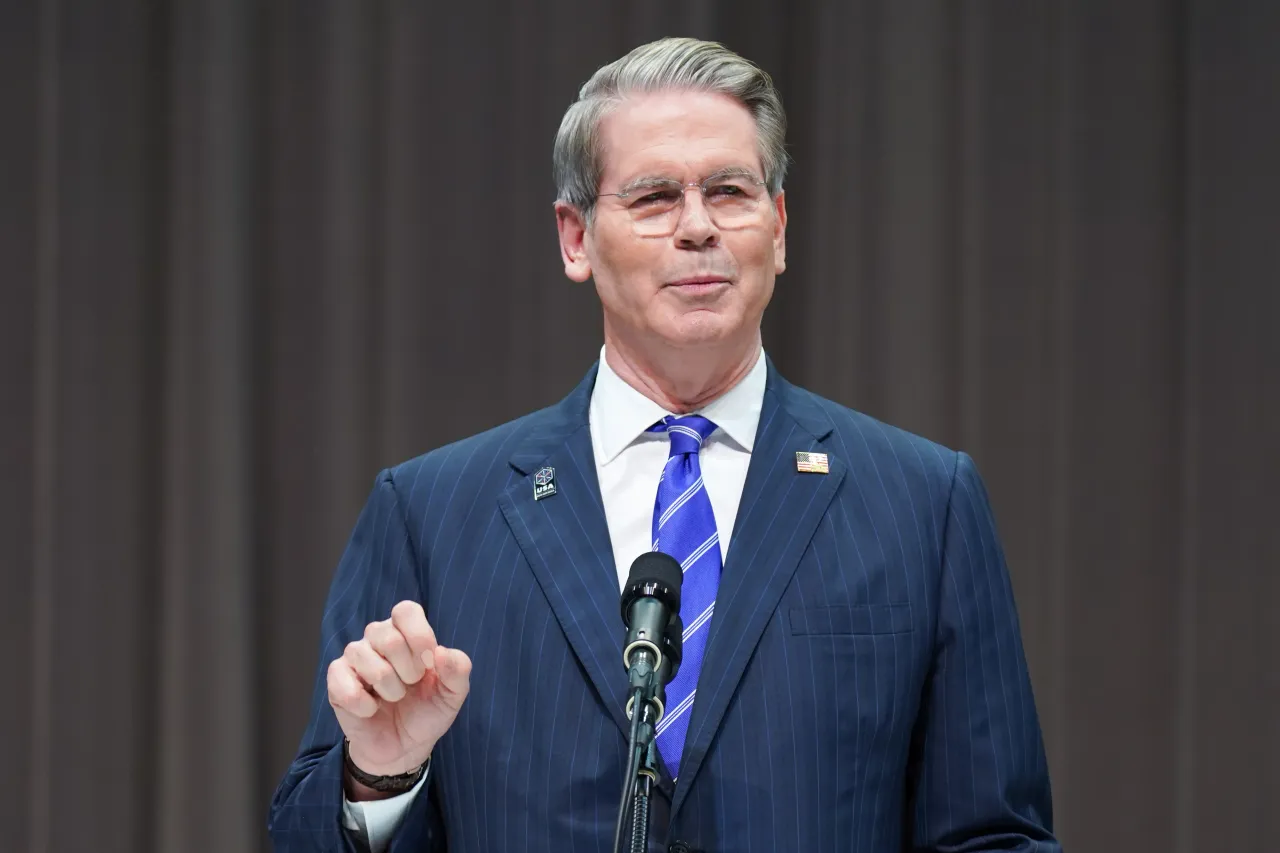

Scott Bessent Says Interest Rates Should Be 150-175 Basis Points Lower: Report

Treasury Secretary Scott Bessent reportedly said on Wednesday that the Federal Reserve’s benchmark borrowing rates should be at least 150 to 175 basis points lower.

In an interview with Bloomberg, Bessent said the interest rates are “too constrictive,” reiterating President Donald Trump’s calls for the central bank to cut rates.

While traders have factored in a 25-basis-point interest rate cut in September, according to CME Group’s FedWatch tool, Bessent said he expects the central bank to cut rates by 50 basis points, according to the report.

“There’s a very good chance of a 50 basis point rate cut. We could go into a series of rate cuts here, starting with a 50 basis point rate cut in September,” he said, according to the report. The FedWatch tool shows a 99.9% probability of a 25-basis-point interest rate cut, and a 0.1% probability of a 50-basis-point cut.

Earlier in August, Federal Reserve Bank of St. Louis President Alberto Musalem backed the central bank’s decision to keep interest rates unchanged, saying that the Fed is missing more on managing the inflation side of its mandate.

Meanwhile, U.S. equities gained in Wednesday’s pre-market session. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up 0.27%, while the Invesco QQQ Trust (QQQ) gained 0.34%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘neutral’ territory.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1163170868_jpg_3975bd8be2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)