Advertisement|Remove ads.

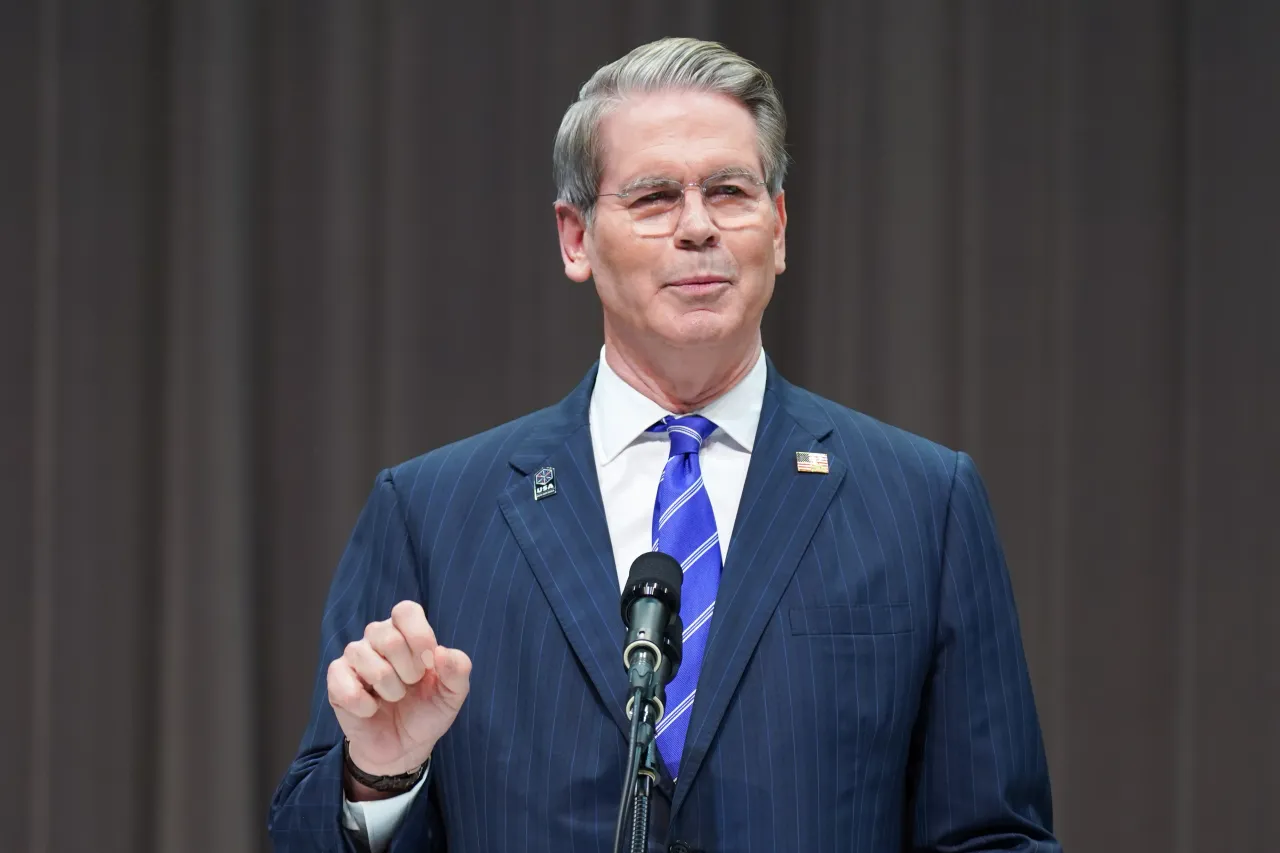

Scott Bessent Says Fed Is Behind Curve, Trump’s Trade Reset Could Bring $300B In Tariffs

U.S. Treasury Secretary Scott Bessent on Thursday said there’s “something wrong” when the Federal Reserve doesn’t cut interest rates even after the jobs data was revised.

In an interview with MSNBC, the Treasury Secretary also noted that the trade deals with other countries are “largely done”, citing that tariffs could bring in over $300 billion in the coming year. “Tariffs are flowing into the USA at levels not thought even possible,” U.S. President Donald Trump wrote in a post on Truth Social shortly after Bessent’s interview.

According to Bessent, President Trump's new duty policy is not the "biggest trade shock" since 1935, referring to when the Smoot-Hawley Tariff Act, which raised levies on over 20,000 imported goods, was introduced to counter the effects of the Great Depression. He did, however, describe the shift in policy with China as a "reset" and a "trade shock."

The Treasury Secretary also announced that Micron Technology (MU) would invest $200 billion in the country. Micron’s stock jumped more than 2% in pre-market trade, with retail sentiment on Stocktwits in ‘bullish’ territory over the past day.

U.S. markets were also moving higher in early morning trade. The SPDR S&P 500 ETF (SPY) rose 0.77%, while the SPDR Dow Jones Industrial Average ETF (DIA) gained 0.19%. The Invesco QQQ Series 1 Trust (QQQ), which tracks the tech-heavy Nasdaq 100, was up 1.26%. On Stocktwits, retail sentiment around the S&P 500 ETF remained in ‘neutral’ territory. However, retail sentiment around QQQ improved to ‘bullish’ territory from ‘neutral’ a day ago.

Read also: Trump Pushes For Intel CEO Resignation, Says He’s ‘Highly Conflicted’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)