Advertisement|Remove ads.

Sealsq Stock Rises After Disclosing Debt-Free Balance Sheet, Expansion Plans – But Retail Remains Skeptical

Sealsq (LAES) shares gained around 2% morning trade on Tuesday, breaking their four-day losing streak, after the company announcing that it is debt-free and “well positioned” for international expansion.

The statement came as part of a shareholder letter announcing its earnings release on March 21.

Sealsq, a subsidiary of WISeKey International Holding (WKEY), disclosed that it has eliminated all convertible debt and warrants.

The company also revealed it has $93 million in potential sales opportunities through 2028, with over 40 of those tied to its TPM quantum-resistant technology.

The company said the growing adoption of such security solutions will be central to its long-term strategy.

Sealsq reported that its cash reserves peaked above $90 million in January 2025 and said it expects revenue gains from its $5 million investment in research and development over the past year to materialize in early 2026.

The company also reaffirmed its plan to roll out its SEAL Quantum-as-a-Service platform in 2025.

SEALSQ said it is “well-positioned” to expand its international footprint, secure additional key partnerships, scale production capacity, develop post-quantum ASICs, and strengthen the cybersecurity ecosystem.

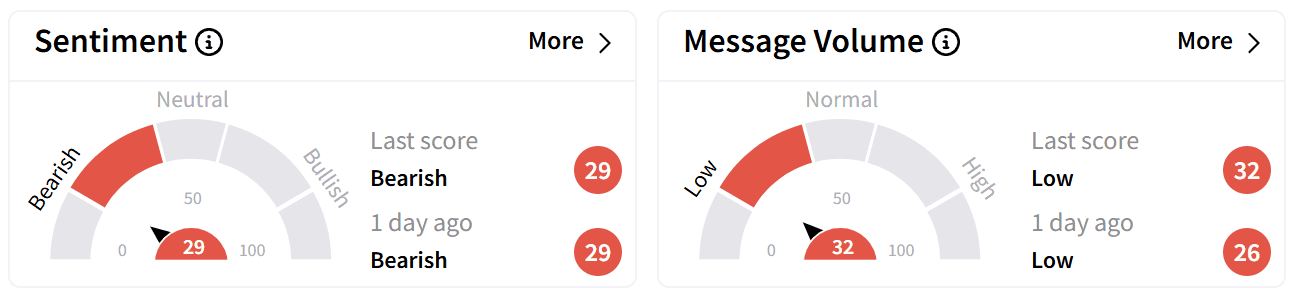

On Stocktwits, retail sentiment around Sealsq’s stock remained in the ‘bearish’ zone, accompanied by ‘low’ levels of chatter.

However, some users on the platform celebrated the company’s bullish, forward-looking outlook.

The company was recently in the news for collaborating with Elon Musk's SpaceX to launch a constellation of satellites that will provide secure IoT connectivity. According to the company, the satellites will use post-quantum cryptography to secure communication technologies.

The first satellite was successfully launched on Jan. 14, with six more planned for later this year.

Despite a steep 66% decline in 2025, the stock remains up 12% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Vistra Stock Dips Pre-Market Despite BofA Upgrade To ‘Buy’ – Retail Sentiment Remains Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Wingstop_jpg_0737a8a046.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239899916_jpg_cde8ab32f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_solaredge_technologies_resized_56b964ed87.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_fiverr_resized_b6733a31a5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240244443_jpg_6b67e8f303.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Crowdstrike_logo_resized_cce5c5379f.jpg)