Advertisement|Remove ads.

India's Steel Stocks See Renewed Spark As Analysts Flag Strong Tailwinds: Here Are Some Top Picks

India's steel sector is on a roll, gaining momentum following the government's recent move to impose a 12% safeguard duty on steel imports to protect domestic manufacturers.

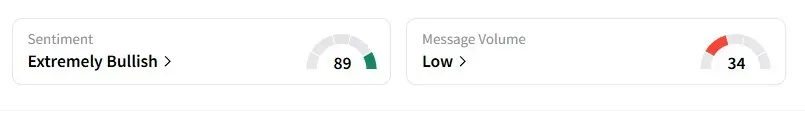

Data on Stocktwits indicates that retail sentiment on the metal index has turned 'extremely bullish' from 'neutral' yesterday.

Financial Independence, a SEBI-registered advisor, has identified multi-cap opportunities in the metals sector on Stocktwits India. They note that overall sentiment for metal counters is bullish in the near term, driven by catalysts such as the earnings season, rising steel prices, and capital expenditure trends.

Here are their top picks across the spectrum:

1. JSW Steel is flagged as the sector leader. Backed by a strong balance sheet and volume-led growth, it's seen as a core portfolio stock, especially attractive on dips for long-term portfolios. Institutional interest remains high.

2. Tata Steel is another heavyweight gaining traction. Despite past margin pressures due to global headwinds, the company's restructuring of its European operations and renewed focus on domestic business make it a solid long-term bet. They recommend that long-term investors can accumulate this stock gradually.

3. Jindal Stainless is showing strong midcap momentum, benefitting from niche leadership in stainless steel. The stock is riding demand from EVs, railways, and industrial sectors. The stock's technical charts indicate an uptrend with strong institutional interest.

4. Jindal Steel and Power is being considered a turnaround play. The company has strengthened its balance sheet, reduced debt, and is capitalising on rising construction activity, making it suitable for both positional and long-term investors.

5. SAIL, the public sector unit major, is seen as a value pick trading at a discount to peers. It's a cyclical opportunity play with breakout potential in the short-to-medium term, especially during commodity rallies. The advisor suggests watching for breakout levels and volume confirmation.

6. Shyam Metalics, a smallcap with a diversified product base, is recommended for high-risk, high-reward investors. Its operational efficiency and earnings visibility have caught the attention of market participants.

Meanwhile, another SEBI-registered analyst, Priyank Sharma, highlighted a critical technical setup for SAIL, noting a bullish breakout potential above ₹130, which could trigger a sustained rally.

Conversely, a break below ₹100 may expose the stock to downside targets near ₹81.80.

Sharma adds that the ₹100–₹200 range currently represents a consolidation zone with no clear directional bias, requiring close monitoring of price action at these key levels.

The Nifty Metal Index remains flattish year-to-date (YTD), up just 0.6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AT_and_T_store_resized_542005da9b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_barr_OG_jpg_6005cfe225.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stocks_jpg_a3427ddfd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1900667440_jpg_c3b8e52a81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1207431426_jpg_b8d7c6d852.webp)