Advertisement|Remove ads.

SEC Charges Carl Icahn And Icahn Enterprises For Failing To Disclose Information Regarding Pledges, Retail Sentiment Sours

Shares of Icahn Enterprises fell over 6% on Monday after the Securities and Exchange Commission (SEC) announced charges against Icahn Enterprises (IEP) and its founder and activist investor Carl Icahn.

The charges were leveled for failing to disclose information relating to Icahn’s pledges of IEP securities as collateral to secure personal margin loans worth billions of dollars under agreements with various lenders.

The regulator said IEP and Icahn have agreed to pay $1.5 million and $500,000 in civil penalties, respectively, to settle the charges.

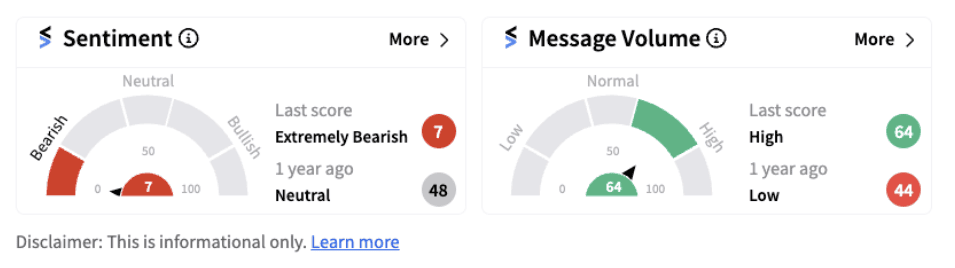

Following the development, retail sentiment on Stocktwits dipped into ‘extremely bearish’ territory (7/100) from ‘neutral’ a day ago, accompanied by ‘high’ message volumes (64/100).

From at least December 31, 2018, through the present, Icahn pledged approximately 51% to 82% of the firm’s outstanding securities as collateral to secure personal margin loans worth billions of dollars under agreements with various lenders.

“Notwithstanding Icahn’s various margin loan agreements and amendments, IEP failed to disclose Icahn’s pledges of IEP securities as required in its Form 10K until February 25, 2022,” the SEC said.

The SEC also indicated that Icahn failed to file amendments to Schedule 13D describing his personal margin loan agreements and amendments, which dated back to at least 2005. He also failed to attach required guaranty agreements, the regulator noted. The activist investor’s failure to file the required amendments to Schedule 13D persisted until at least July 9, 2023.

Osman Nawaz, Chief of the SEC Enforcement Division’s Complex Financial Instruments Unit (CFIU) said the disclosures would have revealed that Icahn pledged over half of IEP’s outstanding shares at any given time. “Due to both disclosure failures, existing and prospective investors were deprived of required information,” he said.

According to an SEC order, Icahn’s total outstanding principal amount of loans amounted to as much as $5 billion by the end of December 2022.

In May 2023, short-seller Hindenburg Research had reportedly highlighted Icahn’s margin borrowing. However, on July 5, 2024, Icahn filed an amendment to Schedule 13D that attached the Omnibus Guaranty Agreement. IEP and Icahn have agreed to cease and desist from future violations and to pay the civil penalties without admitting or denying the findings.

Stocktwits users are expressing disappointment on the development. One user named 'Lookingtoinvest' noted the news does not look good on the company.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)