Advertisement|Remove ads.

SolarEdge Stock Dips After TD Cowen Downgrade, Yet Retail Sentiment Steady on European Progress

Shares of SolarEdge Technologies Inc. ($SEDG) fell over 2% pre-market Monday after TD Cowen downgraded the stock from ‘Buy’ to ‘Hold’, slashing its price target from $35 to $16.

The brokerage attributed the downgrade to deteriorating demand in Europe, where Chinese competitors are aggressively undercutting prices to gain market share.

TD Cowen now expects SolarEdge to hit its $550 million revenue and 23% gross margin target by the fourth quarter of 2025, a delay from the previous guidance for Q2 2025.

The brokerage also projects free cash flow turning positive in the second half of next year, instead of the first half.

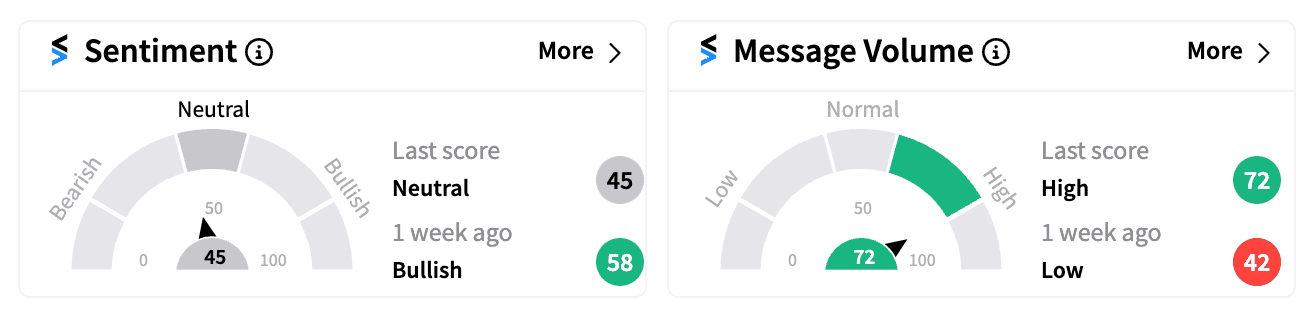

On Stocktwits, retail sentiment for SolarEdge dipped to ‘neutral’ (45/100) by 8:15 am ET, down from ‘bullish’ the previous day.

However, some retail investors appeared to have found optimism in positive regulatory developments.

SolarEdge announced that its portfolio of PV inverters had achieved early certification for compliance with the European Commission’s New Radio Equipment Directive (RED), Article 3.3, which establishes cybersecurity standards for all IoT products sold in Europe.

This directive is set to come into effect in August 2025 and will require PV systems relying on wireless connectivity to comply with stringent new security measures, including enhanced network protection, personal data safeguarding, and fraud risk reduction.

Some investors are also hopeful that demand for solar panels will rebound, supported by the potential easing of interest rates in the coming months.

SolarEdge stock is down over 81.51% year-to-date.

For updates and corrections email newsroom@stocktwits.com

Read next: UPS Stock Falls Pre-Market After Barclays Downgrade, Retail Confidence Dips

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229072591_jpg_18a80f859a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227931369_jpg_250f28d52d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2253201649_jpg_ff6c9e331b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)