Advertisement|Remove ads.

UPS Stock Falls Pre-Market After Barclays Downgrade, Retail Confidence Dips

Shares of United Parcel Service, Inc. ($UPS) dropped nearly 1.8% pre-market Monday following a downgrade from Barclays.

The brokerage reportedly lowered its rating on UPS to ‘Underweight’ from ‘Equal Weight’, maintaining a price target of $120.

Barclays noted that UPS’s near-term earnings could face pressure from weak parcel demand, while long-term concerns like Amazon ($AMZN) competition, non-unionized FedEx ($FDX) competition, and limited dividend growth weigh on the stock’s outlook.

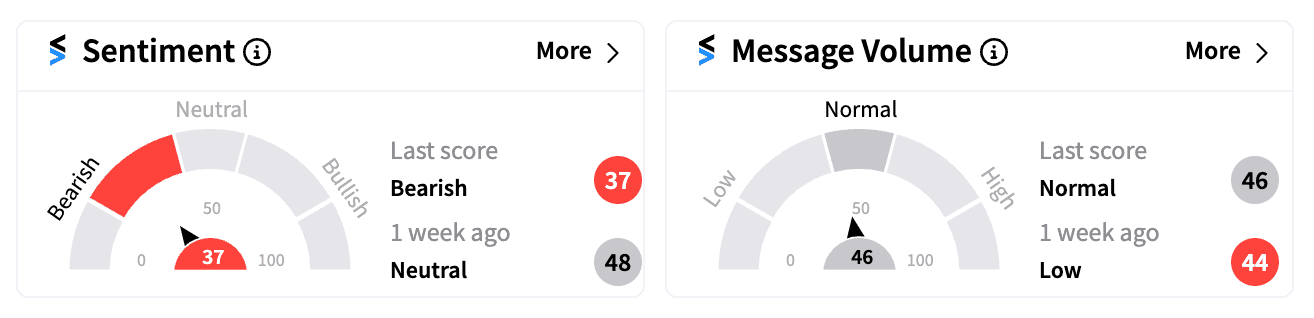

On Stocktwits, retail sentiment for UPS flipped from ‘neutral’ to ‘bearish’ as of 7:30 am ET Monday.

UPS is expected to report its third-quarter earnings later this week, with analysts projecting an increase in EPS to $1.63 from $1.57 last year, and revenue rising to $22.1B from $21.06B a year ago.

The company is undergoing a turnaround plan focused on increasing volumes and cutting costs, but in July, UPS missed profit estimates and trimmed its full-year forecast.

While it managed to increase U.S. package volumes for the first time in two years, the packages are reportedly smaller and less profitable.

Additionally, UPS is dealing with the financial impact of a new Teamsters union contract negotiated last year.

Bloomberg recently reported that both UPS and FedEx have cut forecasts, partially blaming many customers choosing cheaper ground shipping options over air delivery.

The warnings come just ahead of the crucial holiday season and earnings reports.

UPS shares are down over 14% year-to-date, while FedEx is up over 8%, and Amazon has gained more than 25%.

For updates and corrections email newsroom@stocktwits.com

Read next: Walt Disney, VSee Health, Genprex: Retail Most Bullish On These 3 Stocks Pre-Market

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)