Advertisement|Remove ads.

SolarEdge Stock Falls As Analysts Warn Of Trump-Era Hurdles After Q3 Miss: Retail Hopes Clouded

SolarEdge Technologies, Inc. ($SEDG) shares fell Thursday, extending weekly losses to nearly 16% after a dismal third-quarter earnings report and a wave of downgrades from Wall Street analysts who flagged potential regulatory headwinds under the newly elected Trump administration.

Following SolarEdge’s Q3 report, Mizuho analyst Maheep Mandloi downgraded SEDG to ‘Neutral’ from ‘Outperform’ with a drastic price target cut to $11 from $35, citing reduced European demand, low “fire-sale” prices, and lower earnings before interest, taxes, depreciation, and amortization (EBITDA) margins through at least 2026.

The report underscored the risk of tax credit rollbacks and slower growth in the U.S. under Trump, as well as a lack of clear visibility on when demand might rebound.

SolarEdge reported a Q3 loss of $15.33 per share, worse than a feared loss of $1.63 per share, and revenue of $260.9 million, slightly below the $269.38 million forecast.

The quarter included a $1.03 billion asset impairment, prompting SolarEdge to focus on three main goals: financial stability, regaining market share, and concentrating on core solar and storage offerings.

For Q4, the company projects revenue between $180 million and $200 million, well below the $308.66 million consensus, with an expected gross margin ranging from negative 4% to 0%.

Other analysts voiced concerns about the impact of Trump’s win on the sector, even before earnings results, with BofA Securities downgrading SolarEdge to ‘Underperform.’

Analysts suggested Trump’s proposed amendments to the Inflation Reduction Act and increased tariffs could hinder the appeal of rooftop solar, affecting companies like SolarEdge and Enphase Energy ($ENPH).

Deutsche Bank had noted that anticipated regulatory rollbacks may bring downward pressure and volatility to the solar space, especially affecting Sunnova Energy ($NOVA) and Sunrun ($RUN). But it sees a less significant, though still negative, impact on Enphase and SolarEdge.

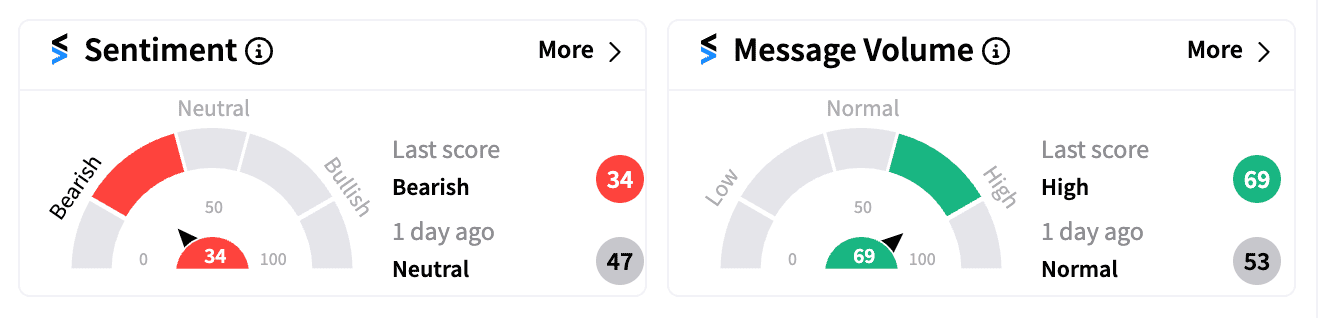

Retail sentiment on Stocktwits dipped from ‘neutral’ to ‘bearish’ amid an uptick in chatter on Thursday afternoon, with some skeptical of the company’s future under possible policy shifts.

Some even took note of Piper Sandler slashing its price-target from $17 to $9 on SEDG.

SolarEdge’s stock has lost over 80% this year, with recent developments adding further uncertainty.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)