Advertisement|Remove ads.

Sempra Energy Stock Recovers From Historic Sell-Off Despite Wall Street Downgrades – Retail Sentiment Shows Resilience

Sempra Energy (SRE) shares edged up 2% in afternoon trading Wednesday, recovering slightly after the utility suffered its steepest-ever intraday decline on Tuesday.

The stock plunged more than 18% following fourth-quarter (Q4) earnings that missed expectations and a surprise cut to its 2025 guidance, triggering a wave of analyst downgrades.

Goldman Sachs and UBS both downgraded Sempra, citing diminished confidence in the company’s outlook, according to TheFly.

Goldman Sachs lowered its rating to ‘Neutral’ from ‘Buy’ and slashed its price target to $76 from $99, reflecting an implied total return of 11%.

Analysts at the firm pointed to Sempra’s revised earnings guidance and concerns over regulatory filings, stating that the unexpected reset in 2025 earnings projections was a significant downside shock.

Goldman noted that it would take time for the company to rebuild credibility in executing its strategy. The firm also sees limited near-term catalysts to boost earnings projections.

UBS also downgraded Sempra to ‘Neutral’ from ‘Buy, ’ cutting its price target to $78 from $95.

The firm said the company’s earnings rebase and 11% guidance reduction prompted a reassessment of its growth potential.

UBS highlighted heightened uncertainty over whether Sempra can maintain its target of 9% or better EPS growth through 2029.

It also flagged increased regulatory risks, particularly in California’s cost-of-capital proceeding and an upcoming general rate case filing in Texas for Oncor.

Despite the sell-off, Guggenheim took a more measured stance, calling Tuesday’s sharp decline “overdone.” The firm maintained a ‘Buy’ rating on Sempra but lowered its price target to $87 from $95.

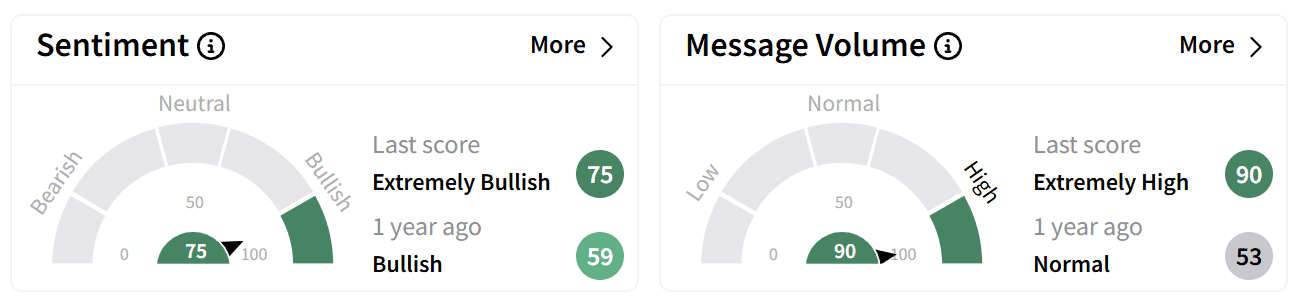

Despite Wall Street’s bearish commentary around the company, retail sentiment on Stocktwits improved to ‘extremely bullish’ from ‘bullish’ a day ago as chatter surged to ‘extremely high’ levels.

The average price target on Sempra shares now stands at $89.57, suggesting a 24% upside from current levels, according to Koyfin data.

Sempra Energy's stock has traded flat in 2025, with an 18% dip in value over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)